Could the DUP’s VAT win break-up the UK’s VAT union? asks Richard Asquith (Avalara).

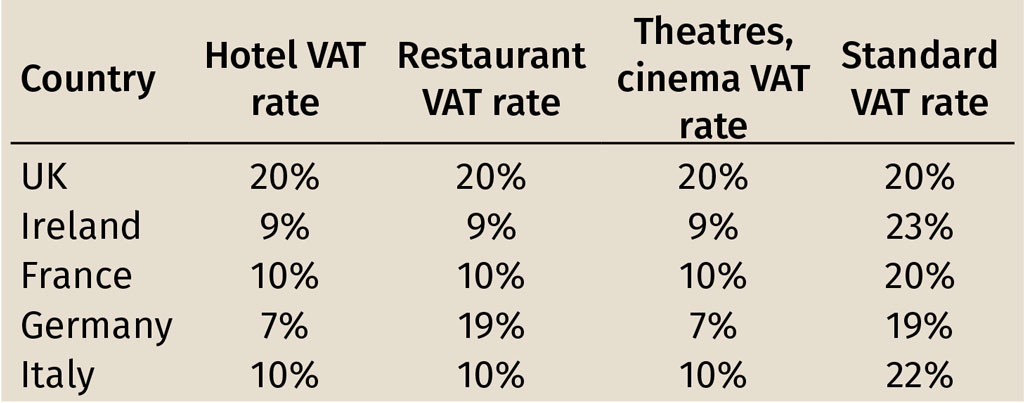

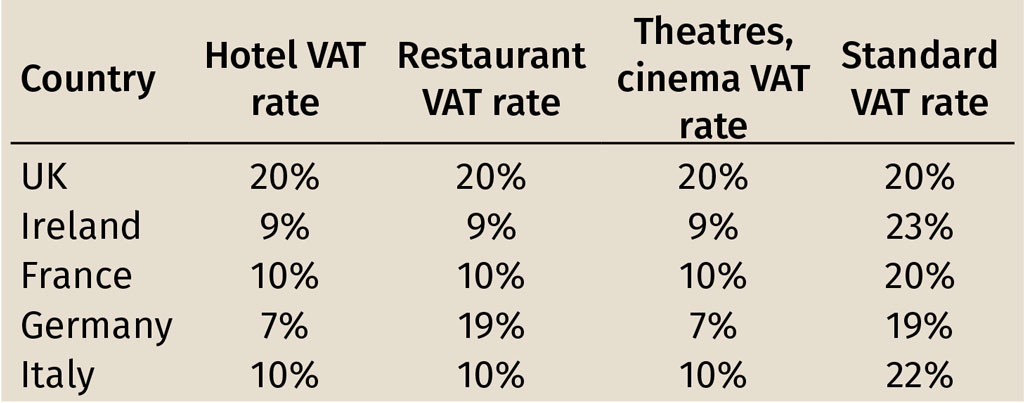

Last week’s Spring Statement included the launch of a consultation around Northern Ireland cutting its reduced tourism-related services VAT rate to compete with Ireland’s 9% rate. Currently, Northern Ireland hotel accommodation, taxi, cinema and tourist entry ticket prices must be at the UK standard rate of 20%.

Such a regional change in VAT could become feasible after Brexit, signalling a break-up of the UK VAT union. Meaning VAT goes the same way as Scottish devolved income tax.

DUP power sharing deal with Tories grips VAT policy

The UK has long resisted the urge to give special treatment to tourism. Aside from Denmark, it is the only EU country not to do so. Aside from eroding the tax base when revenues are already under pressure, it would have been viewed as creating a precedent for other pressure groups.

But the post-2015 general election power sharing agreement with the unionist Democratic Unionist Party (DUP) has forced a change. As part of the DUP ‘confidence and supply’ agreement for parliamentary votes, the Conservatives conceded to review Northern Ireland tourism policy.

Ireland’s tourism VAT subsidy success

The DUP has long-eyed the success of Ireland’s reduced VAT policy, and complained that it saps tourist numbers from north of the border. Ireland cut its VAT rate to 9% in 2012 in the midst of the financial and euro crises. It has been claimed that this saved over 35,000 hospitality jobs by subsidising one of Ireland’s top three industries. The cost has been estimated at €35m per annum.

Despite the Irish economy’s rebound from the depths of crises, trade lobbying has kept the cut in place for the foreseeable future.

UK alone in higher tourism VAT rates

Currently, the UK is one of the few countries in the EU to charge full VAT on such hospitality services. Almost all member states have long provided a VAT break to this strategic sector, with considerable boosts in job creation and international visitor numbers.

Under European Union membership rules, VAT may only be set and raised at the national level – which means under the control of Westminster for the UK.

The VAT review could signal a 2022 UK VAT union break-up

As a member of the EU VAT regime, and bound by the EU VAT Directive, the UK may not vary VAT on a regional basis. However, following Brexit, this will change, and the UK could start varying rates and rules provincially. The precedent of devolved income tax for Scotland shows this is very likely.

But what date? Brexit, by force of law, is due on 29 March 2019. However, the government seems likely to accept the EU’s offer of a 21-month transition phase – which would mean 31 December 2021.

UK VAT amendments for 2022 may include more than Northern Ireland tourism VAT changes.

Could the DUP’s VAT win break-up the UK’s VAT union? asks Richard Asquith (Avalara).

Last week’s Spring Statement included the launch of a consultation around Northern Ireland cutting its reduced tourism-related services VAT rate to compete with Ireland’s 9% rate. Currently, Northern Ireland hotel accommodation, taxi, cinema and tourist entry ticket prices must be at the UK standard rate of 20%.

Such a regional change in VAT could become feasible after Brexit, signalling a break-up of the UK VAT union. Meaning VAT goes the same way as Scottish devolved income tax.

DUP power sharing deal with Tories grips VAT policy

The UK has long resisted the urge to give special treatment to tourism. Aside from Denmark, it is the only EU country not to do so. Aside from eroding the tax base when revenues are already under pressure, it would have been viewed as creating a precedent for other pressure groups.

But the post-2015 general election power sharing agreement with the unionist Democratic Unionist Party (DUP) has forced a change. As part of the DUP ‘confidence and supply’ agreement for parliamentary votes, the Conservatives conceded to review Northern Ireland tourism policy.

Ireland’s tourism VAT subsidy success

The DUP has long-eyed the success of Ireland’s reduced VAT policy, and complained that it saps tourist numbers from north of the border. Ireland cut its VAT rate to 9% in 2012 in the midst of the financial and euro crises. It has been claimed that this saved over 35,000 hospitality jobs by subsidising one of Ireland’s top three industries. The cost has been estimated at €35m per annum.

Despite the Irish economy’s rebound from the depths of crises, trade lobbying has kept the cut in place for the foreseeable future.

UK alone in higher tourism VAT rates

Currently, the UK is one of the few countries in the EU to charge full VAT on such hospitality services. Almost all member states have long provided a VAT break to this strategic sector, with considerable boosts in job creation and international visitor numbers.

Under European Union membership rules, VAT may only be set and raised at the national level – which means under the control of Westminster for the UK.

The VAT review could signal a 2022 UK VAT union break-up

As a member of the EU VAT regime, and bound by the EU VAT Directive, the UK may not vary VAT on a regional basis. However, following Brexit, this will change, and the UK could start varying rates and rules provincially. The precedent of devolved income tax for Scotland shows this is very likely.

But what date? Brexit, by force of law, is due on 29 March 2019. However, the government seems likely to accept the EU’s offer of a 21-month transition phase – which would mean 31 December 2021.

UK VAT amendments for 2022 may include more than Northern Ireland tourism VAT changes.