April will see some significant tax changes come into effect, as well as the usual uprating of tax thresholds. In personal tax, we will see changes to income tax rates and bands – and the first divergence across the UK as new Scottish rates and bands take effect. National insurance thresholds are indexed upwards. The inheritance tax residence nil rate band introduced in 2017/18 will rise to £125,000 for deaths in 2018/19. The pension lifetime allowance is indexed up from £1m to £1,030,000, and the annual tax on enveloped dwellings (ATED) will rise by 3% from 1 April. Landfill tax rates will increase from 1 April 2018, bringing the standard rate to £88.95 per tonne and the lower rate to £2.80 per tonne. CO2 emission thresholds for certain capital allowance purposes change from April 2018. There will be significant change to the rules surrounding termination payments in terms of employment. From 6 April 2018, businesses producing or packaging UK soft drinks with added sugar may be required to pay the soft drinks industry levy.

The main tax changes coming into effect this April are as follows.

APD rates for flights over 2,000 miles (‘band B’ destinations) increase on 1 April. Reduced rates will rise by £3 (to £78), standard rates will rise by £6 (to £156), and higher rates will rise by £18 (to £468).

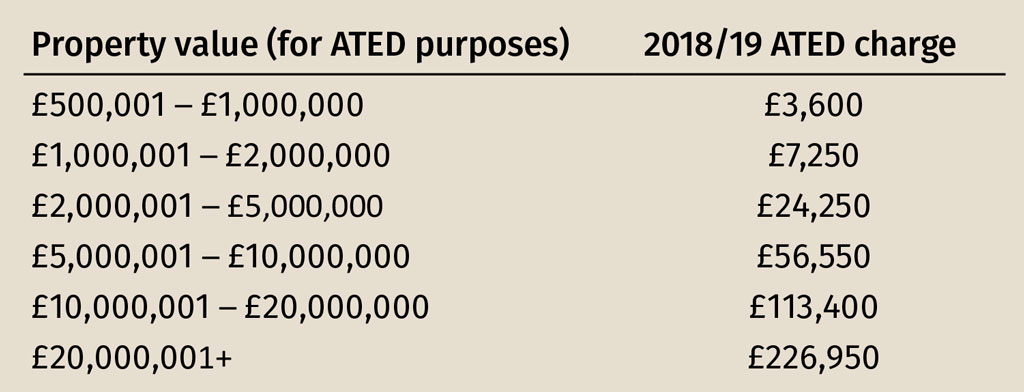

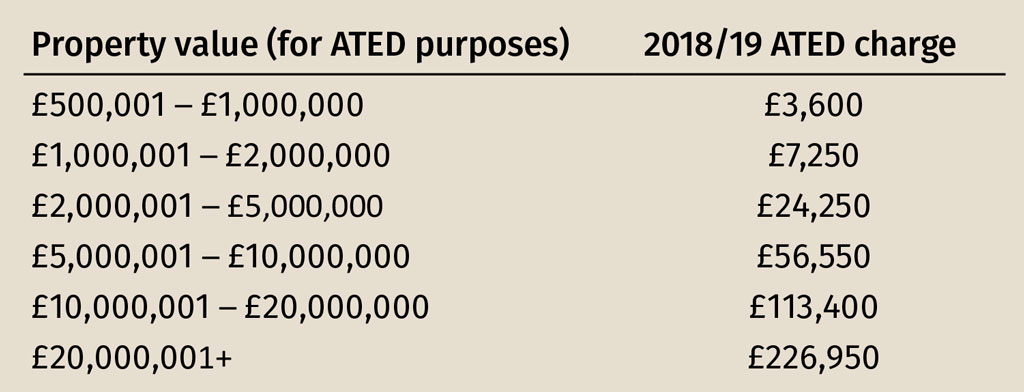

The annual tax on enveloped dwellings (ATED) annual charges will rise by 3% from 1 April (with the ATED increase rounded down to the nearest £50).

Properties on which ATED is payable need to be revalued to the 1 April 2017 value for the purposes of the 2018/19 ATED charge (assuming the property was owned on this date). A professional valuation/pre-return banding check may be appropriate.

The 2018/19 ATED charges are as follows:

First-year tax credits

Under the enhanced capital allowances scheme, a 100% first-year allowance is available for certain energy-saving or environmentally-beneficial plant and machinery. Loss-making companies can claim a payable first-year tax credit in respect of such plant and machinery.

These first-year tax credits were due to expire on 31 March 2018, but have been extended to 31 March 2023.

The amount of first-year tax credits for an accounting period is subject to two limits, one of which was previously fixed at 19% of the amount of loss surrendered. From 1 April 2018, the applicable percentage will be set at two-thirds of the corporation tax rate for the chargeable period, so normally 12.67% currently.

First year allowances for zero-emission goods vehicles and gas refuelling equipment: extended

The availability of 100% first year allowances (FYAs) under CAA 2001 s 45DA in respect of capital expenditure on new zero-emission goods vehicles, was set to expire on 31 March 2018 for corporation tax purposes and 5 April 2018 for income tax purposes. Similarly, the availability of FYAs under CAA 2001 s 45E in respect of new plant and machinery to refuel natural gas, biogas and hydrogen-powered vehicles, was set to expire on 31 March 2018.

The availability of these allowances has since been extended to 2021.

The rates remain at 10% and 20% for assets other than residential properties and carried interest which are taxed at 18% and 28%. The annual exemption will be increased from £11,300 to £11,700 for individuals and from £5,650 to £5,850 for most trusts on 6 April 2018.

The main rates of CCL increase from 1 April 2018.

The CCL exemption for renewable source electricity supplied under a renewable source contract was removed on 1 August 2015. The transitional period, during which time suppliers could continue to exempt renewable source electricity generated before 1 August 2015, ends on 31 March 2018.

The percentages for calculating company car benefits in kind will increase by 2% for most cars. The cleanest electric cars will be taxed at 13% of list price, rising up to 37% for cars emitting 180g/km or more. Diesel supplement will be an additional 4% of list price. (Except for cars certified to the RDE2 standard.)

The benefit in kind for private fuel provided in company cars or vans will be calculated at the relevant percentage x £23,400. The van benefit charge will increase to £3,350 and the fuel benefit charge for vans will increase to £633.

Alternative finance arrangements

Changes have been made to expand the alternative finance arrangements rules in TCGA 1992, ITA 2007 and CTA 2009 – rules designed primarily to apply to types of shari’a-compliant financing arrangements – to now include investment bond arrangements involving securities traded on a multilateral trading facility operated by an EEA-regulated recognised stock exchange. The amendments have effect from 2018/19 for income tax and capital gains tax purposes, and for accounting periods beginning on or after 1 April 2018 for corporation tax purposes.

Withholding tax exemption

In relation to payments made on or after 1 April 2018, the definition of ‘quoted Eurobond’ in ITA 2007 s 987, relevant for an exemption from the requirement to withhold income tax at source on interest payments, has been extended to include securities admitted to trading on a multilateral trading facility operated by an EEA-regulated recognised stock exchange.

Disincorporation relief, introduced in FA 2013 in respect of gains on land or goodwill arising from a company transferring its business to its shareholders, was available only for transfers in the five years from 1 April 2013. The relief has not been extended further, and therefore claims will not be possible in respect of such business transfers occurring on or after 1 April 2018.

The double-tax relief targeted anti-avoidance rule (DTR TAAR), in TIOPA 2010 s 81 et seq, is designed to counter the effect of prescribed avoidance schemes involving credit for foreign taxes. The DTR TAAR has been amended to remove the requirement for HMRC to issue a counteraction notice to the taxpayer, in effect requiring taxpayers to consider the DTR TAAR as a part of self-assessment returns. The changes apply to tax returns where the date by which the return is required to be made is after 31 March 2018.

The EIS income tax relief limit will increase from £1m to £2m from 6 April, provided the additional £1m is invested in ‘knowledge-intensive’ companies’.

A new ‘risk to capital’ condition will be introduced, which is intended to focus EIS, SEIS and VCT reliefs on investments into ‘certain early stage trading companies with high potential for growth and development’. This condition may apply from royal assent to the Finance Act 2018, i.e. 15 March 2018, subject to regulations being made.

From 6 April, the government will make the following further changes to VCTs:

Certain historic rules that provide more favourable conditions for some VCTs (‘grandfathered’ provisions) will be removed. If VCTs issue further shares to investors (following the first issue of shares to investors), they must invest at least 30% of funds raised in qualifying holdings within 12 months from the end of the accounting period in which the further issue is made. VCTs will be required to hold a minimum of 80% qualifying holdings, increased from 70%.

The fulfilment houses due diligence scheme applies to businesses that store goods imported from outside the EU for or on behalf of someone outside the EU. From 1 April 2018, fulfilment houses will be able to register with HMRC under the scheme. Fulfilment houses trading before 1 April 2018 must apply for registration by 30 June 2018, fulfilment houses that start trading between 1 April and 30 June 2018 must apply by 30 September 2018, and fulfilment houses that start trading after 1 July 2018 must apply before 1 October 2018 or the day they commence the business (whichever is earlier).

Businesses covered by the scheme must be registered by 1 April 2019, and from that date will be required to keep records of overseas customers’ details (including verified VAT registration numbers) and report suspect vendors to HMRC.

As of 6 April, the personal allowance will be increased from £11,500 to £11,850, and the basic rate band from £33,500 to £34,500, giving a higher rate threshold of £46,350 for 2018/19.

The rate bands for 2018/19 are 20% on taxable income up to £34,500 and 40% on income between £34,501 and £150,000. A 0% rate applies to the first £5,000 of taxable savings income, although this rate will only affect people with non-savings income of less than £16,850 (in 2018/19). The dividend nil rate band will be reduced to £2,000 of dividend income (from £5,000 in 2017/18) and the savings nil rate will remain at the same rates as 2017/18 (£1,000 for basic-rate taxpayers, £500 for higher-rate taxpayers and £0 for additional-rate taxpayers).

The marriage allowance allows a transfer up to 10% of one spouse’s personal allowance to the other, reducing their overall tax bill by up to £238 a year in 2018/19. The government will now allow claims in cases where a partner died before the claim was made. These claims can be backdated by up to four years.

Scottish resident individuals are subject to Scottish rates of income tax from 6 April. For 2018/19, a new starter rate of 19% will apply to incomes between £11,850 and £13,850. The basic rate of income tax of 20% will continue to apply between £13,850 and £24,000 and a new intermediate rate of 21% will be introduced for income between £24,000 and £43,430. Higher rate tax on income between £43,430 and £150,000 is increased to 41% and additional rate tax for income above £150,000 is also increased from 45% to 46%. These new Scottish rates apply to non-savings income only (generally earnings). The tax rates applicable to savings and dividend income continue to be set by Westminster.

The inheritance nil rate band remains at £325,000 for 2018/19. The residence nil rate band which was introduced in 2017/18 will increase from £100,000 to £125,000 for deaths in 2018/19, £150,000 for deaths in 2019/20 and will rise to £175,000 for deaths on or after 6 April 2020. It is tapered at £1 for £2 for estates over £2m.

The ISA annual subscription limit remains at £20,000, and that for junior ISAs and child trust funds, the limit will be increased to £4,260 on 6 April 2018.

The landfill tax rates increase from 1 April 2018. This increases the standard rate to £88.95 per tonne and the lower rate to £2.80 per tonne.

The rules in relation to landfill tax will also be amended from 1 April 2018, to include within the scope of landfill tax disposals at sites without an environmental disposal permit (illegal waste sites) and to amend what constitutes a ‘taxable disposal’ for landfill tax purposes.

From 1 April 2018, landfill disposals tax will replace landfill tax in Wales. Landfill disposals tax will be administered by the Welsh Revenue Authority and will be payable by landfill operators in Wales. The rates are currently the same as landfill tax.

CO2 emission thresholds for certain capital allowance purposes change from April 2018:

The relevant emissions thresholds for the 15% restriction on corporation tax and income tax deductions for the costs of car hire (CTA 2009 s 56, ITTOIA 2005 s 48), are linked to the CAA thresholds and therefore reduce to 110 grams per kilometre from 1 and 5 April 2018 respectively, subject to grandfathering rules for existing leases.

Unincorporated property businesses will now have the option of calculating their allowable deductions for vehicle expenditure using the simplified flat rates based on business miles travelled, commonly referred to as ‘mileage rates’. These mileage rates are already available for self-employed traders and employees.

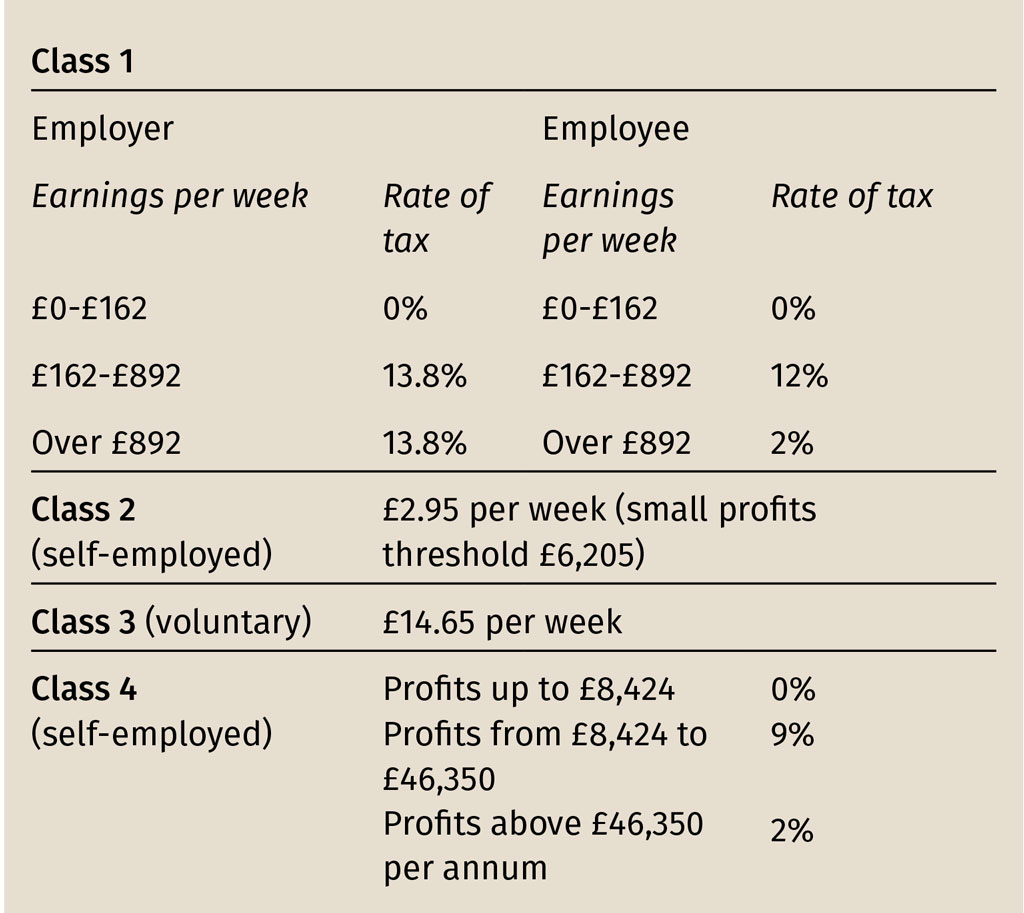

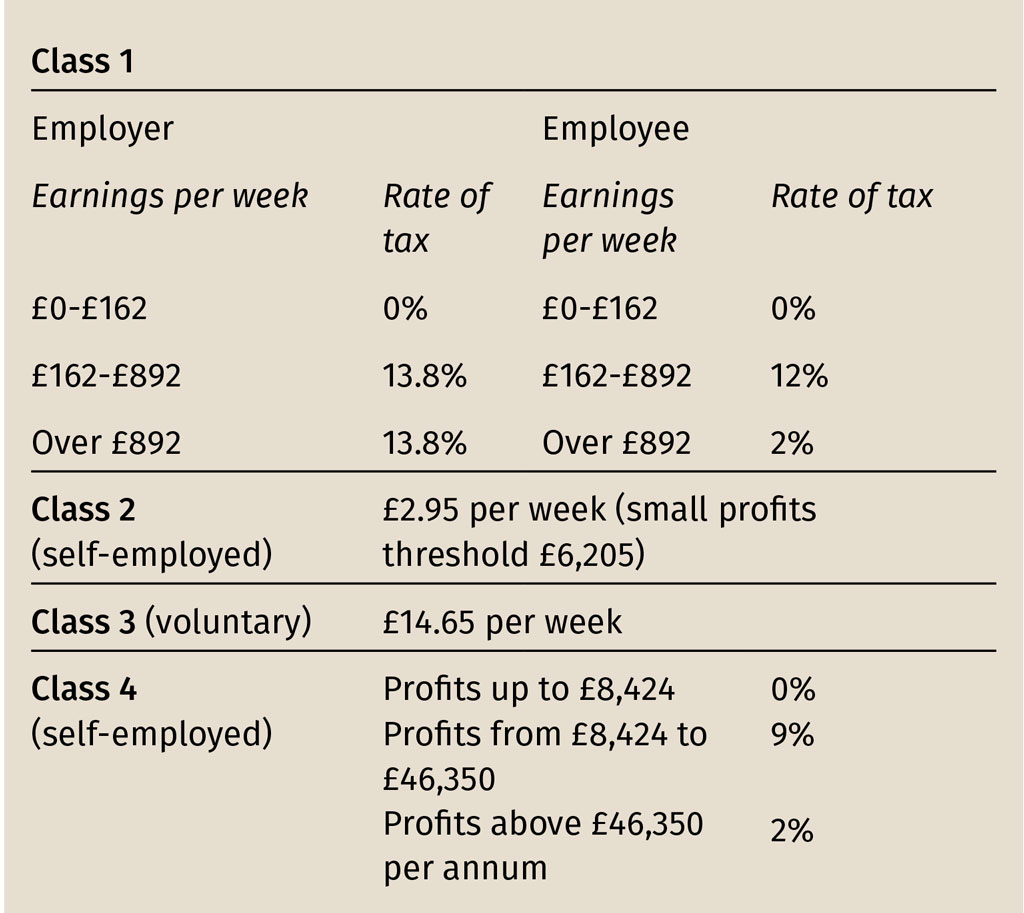

In 2018/19, the NIC rates will be as follows:

A number of changes were made to the taxation of offshore trusts, and to settlors and beneficiaries of those trusts, with effect from 6 April 2017. Further changes will have effect from 6 April 2018. The key points of relevance are:

Employers will soon have to report benefits for the first time (on P11Ds for 2017/18) taking account of the new OpRA legislation in force since 6 April 2017. OpRA applies when an employee receives a benefit instead of earnings, including arrangements under salary sacrifice/bonus waivers, cash alternatives, flexible benefits, and trade up/trade down arrangements for example. Broadly speaking the value of benefits provided under OpRA, will be the higher of the amount of earnings foregone or the taxable value of the benefit that would otherwise apply, although there are some exceptions. Arrangements that existed before 5 April 2017 for company cars and vans, private fuel, living accommodation and school fees can continue to be based on the existing rules without applying OpRA until 5 April 2021; or until 5 April 2018 in the case of other benefits. However, if any variation or renewal of an OpRA arrangement takes place before these dates, OpRA kicks in at that time for the benefit concerned. The overall value of a taxable benefit for the year in these circumstances will need to be calculated partly under the old rules, and partly under the new OpRA rules.

From 2018/19, the beneficiary of a bare trust will be treated as if they were a partner for UK income tax purposes, provided they are absolutely entitled to the trustee partner’s share of the profits of the firm.

A simplified process will allow employers to make permanent PAYE settlement agreements, rather than having to set up a new agreement every tax year. The new permanent agreements will be available from 6 April 2018. Computations will, of course, still have to be submitted annually.

From 2018/19, the lifetime allowance will increase from £1m to £1,030,000. This will come into effect as of 6 April 2018.

Further restriction of mortgage interest on rental properties

Phasing in since 2017/18 to 2020/21, the deduction for mortgage interest in respect of let properties will continue to be restricted to a basic rate tax reducer from 6 April 2018. In 2018/19, finance costs on residential properties will be further restricted such that only 50% finance costs will be an allowable deduction (down from 75% in 2017/18) and the remaining 50% will be given as a basic rate tax reduction (up from 25% in 2017/18). These percentages reduce and increase respectively over the period so that solely a basic rate reducer is available by 2020/21.

Land and buildings transaction tax (LBTT)

From 1 April, there is a requirement for certain commercial leaseholders in Scotland to submit a LBTT return every three years from the effective date of the lease.

Land transaction tax (LTT)

From 1 April, land transaction tax (LTT) will replace UK stamp duty land tax (SDLT) in Wales.

From 6 April 2018, businesses that produce, package or bring into the UK soft drinks with added sugar may need to register for and pay the soft drinks industry levy. The amount payable depends upon the sugar content of the drink. The levy is set at 18p per litre if the drink has 5g of sugar or more per 100ml, and 24p per litre if the drink has 8g of sugar or more per 100ml. Returns must be made quarterly, with the first return due in July 2018.

Payments in lieu of notice (PILONs) will become subject to tax as earnings and class 1 NIC where an employment is terminated after 5 April 2018 and any termination payment is also made after that date, subject to a new statutory formula. The balance of any termination award exceeding £30,000 will also become subject to class 1A NIC, but this will come into effect from 6 April 2019, having been delayed by a year. Injury to feelings will be excluded from the definition of ‘injury or disability’. Employers are advised to be particularly vigilant when applying the new rules as there are many grey areas and computational challenges.

Foreign service relief for employees who have had international careers will no longer be available for any employees who are UK resident at the time of termination, if after 5 April 2018. These employees will have to rely on international tax treaties for any relief in future.

Owners and leasers of tobacco manufacturing machinery are required to obtain a licence for each machine. Applications for licences will be accepted from 1 April 2018 and the Scheme will come into force on 1 August 2018.

From 1 April 2018, VED rates for cars, vans and motorcycles will increase.

A diesel supplement is also being introduced from 1 April 2018. The supplement applies to diesel vehicles registered from 1 April 2018 which do not meet the EU real driving emissions step two (RDE2) standard, with the effect that these cars will go up by one VED band when determining the VED rate that applies.

April will see some significant tax changes come into effect, as well as the usual uprating of tax thresholds. In personal tax, we will see changes to income tax rates and bands – and the first divergence across the UK as new Scottish rates and bands take effect. National insurance thresholds are indexed upwards. The inheritance tax residence nil rate band introduced in 2017/18 will rise to £125,000 for deaths in 2018/19. The pension lifetime allowance is indexed up from £1m to £1,030,000, and the annual tax on enveloped dwellings (ATED) will rise by 3% from 1 April. Landfill tax rates will increase from 1 April 2018, bringing the standard rate to £88.95 per tonne and the lower rate to £2.80 per tonne. CO2 emission thresholds for certain capital allowance purposes change from April 2018. There will be significant change to the rules surrounding termination payments in terms of employment. From 6 April 2018, businesses producing or packaging UK soft drinks with added sugar may be required to pay the soft drinks industry levy.

The main tax changes coming into effect this April are as follows.

APD rates for flights over 2,000 miles (‘band B’ destinations) increase on 1 April. Reduced rates will rise by £3 (to £78), standard rates will rise by £6 (to £156), and higher rates will rise by £18 (to £468).

The annual tax on enveloped dwellings (ATED) annual charges will rise by 3% from 1 April (with the ATED increase rounded down to the nearest £50).

Properties on which ATED is payable need to be revalued to the 1 April 2017 value for the purposes of the 2018/19 ATED charge (assuming the property was owned on this date). A professional valuation/pre-return banding check may be appropriate.

The 2018/19 ATED charges are as follows:

First-year tax credits

Under the enhanced capital allowances scheme, a 100% first-year allowance is available for certain energy-saving or environmentally-beneficial plant and machinery. Loss-making companies can claim a payable first-year tax credit in respect of such plant and machinery.

These first-year tax credits were due to expire on 31 March 2018, but have been extended to 31 March 2023.

The amount of first-year tax credits for an accounting period is subject to two limits, one of which was previously fixed at 19% of the amount of loss surrendered. From 1 April 2018, the applicable percentage will be set at two-thirds of the corporation tax rate for the chargeable period, so normally 12.67% currently.

First year allowances for zero-emission goods vehicles and gas refuelling equipment: extended

The availability of 100% first year allowances (FYAs) under CAA 2001 s 45DA in respect of capital expenditure on new zero-emission goods vehicles, was set to expire on 31 March 2018 for corporation tax purposes and 5 April 2018 for income tax purposes. Similarly, the availability of FYAs under CAA 2001 s 45E in respect of new plant and machinery to refuel natural gas, biogas and hydrogen-powered vehicles, was set to expire on 31 March 2018.

The availability of these allowances has since been extended to 2021.

The rates remain at 10% and 20% for assets other than residential properties and carried interest which are taxed at 18% and 28%. The annual exemption will be increased from £11,300 to £11,700 for individuals and from £5,650 to £5,850 for most trusts on 6 April 2018.

The main rates of CCL increase from 1 April 2018.

The CCL exemption for renewable source electricity supplied under a renewable source contract was removed on 1 August 2015. The transitional period, during which time suppliers could continue to exempt renewable source electricity generated before 1 August 2015, ends on 31 March 2018.

The percentages for calculating company car benefits in kind will increase by 2% for most cars. The cleanest electric cars will be taxed at 13% of list price, rising up to 37% for cars emitting 180g/km or more. Diesel supplement will be an additional 4% of list price. (Except for cars certified to the RDE2 standard.)

The benefit in kind for private fuel provided in company cars or vans will be calculated at the relevant percentage x £23,400. The van benefit charge will increase to £3,350 and the fuel benefit charge for vans will increase to £633.

Alternative finance arrangements

Changes have been made to expand the alternative finance arrangements rules in TCGA 1992, ITA 2007 and CTA 2009 – rules designed primarily to apply to types of shari’a-compliant financing arrangements – to now include investment bond arrangements involving securities traded on a multilateral trading facility operated by an EEA-regulated recognised stock exchange. The amendments have effect from 2018/19 for income tax and capital gains tax purposes, and for accounting periods beginning on or after 1 April 2018 for corporation tax purposes.

Withholding tax exemption

In relation to payments made on or after 1 April 2018, the definition of ‘quoted Eurobond’ in ITA 2007 s 987, relevant for an exemption from the requirement to withhold income tax at source on interest payments, has been extended to include securities admitted to trading on a multilateral trading facility operated by an EEA-regulated recognised stock exchange.

Disincorporation relief, introduced in FA 2013 in respect of gains on land or goodwill arising from a company transferring its business to its shareholders, was available only for transfers in the five years from 1 April 2013. The relief has not been extended further, and therefore claims will not be possible in respect of such business transfers occurring on or after 1 April 2018.

The double-tax relief targeted anti-avoidance rule (DTR TAAR), in TIOPA 2010 s 81 et seq, is designed to counter the effect of prescribed avoidance schemes involving credit for foreign taxes. The DTR TAAR has been amended to remove the requirement for HMRC to issue a counteraction notice to the taxpayer, in effect requiring taxpayers to consider the DTR TAAR as a part of self-assessment returns. The changes apply to tax returns where the date by which the return is required to be made is after 31 March 2018.

The EIS income tax relief limit will increase from £1m to £2m from 6 April, provided the additional £1m is invested in ‘knowledge-intensive’ companies’.

A new ‘risk to capital’ condition will be introduced, which is intended to focus EIS, SEIS and VCT reliefs on investments into ‘certain early stage trading companies with high potential for growth and development’. This condition may apply from royal assent to the Finance Act 2018, i.e. 15 March 2018, subject to regulations being made.

From 6 April, the government will make the following further changes to VCTs:

Certain historic rules that provide more favourable conditions for some VCTs (‘grandfathered’ provisions) will be removed. If VCTs issue further shares to investors (following the first issue of shares to investors), they must invest at least 30% of funds raised in qualifying holdings within 12 months from the end of the accounting period in which the further issue is made. VCTs will be required to hold a minimum of 80% qualifying holdings, increased from 70%.

The fulfilment houses due diligence scheme applies to businesses that store goods imported from outside the EU for or on behalf of someone outside the EU. From 1 April 2018, fulfilment houses will be able to register with HMRC under the scheme. Fulfilment houses trading before 1 April 2018 must apply for registration by 30 June 2018, fulfilment houses that start trading between 1 April and 30 June 2018 must apply by 30 September 2018, and fulfilment houses that start trading after 1 July 2018 must apply before 1 October 2018 or the day they commence the business (whichever is earlier).

Businesses covered by the scheme must be registered by 1 April 2019, and from that date will be required to keep records of overseas customers’ details (including verified VAT registration numbers) and report suspect vendors to HMRC.

As of 6 April, the personal allowance will be increased from £11,500 to £11,850, and the basic rate band from £33,500 to £34,500, giving a higher rate threshold of £46,350 for 2018/19.

The rate bands for 2018/19 are 20% on taxable income up to £34,500 and 40% on income between £34,501 and £150,000. A 0% rate applies to the first £5,000 of taxable savings income, although this rate will only affect people with non-savings income of less than £16,850 (in 2018/19). The dividend nil rate band will be reduced to £2,000 of dividend income (from £5,000 in 2017/18) and the savings nil rate will remain at the same rates as 2017/18 (£1,000 for basic-rate taxpayers, £500 for higher-rate taxpayers and £0 for additional-rate taxpayers).

The marriage allowance allows a transfer up to 10% of one spouse’s personal allowance to the other, reducing their overall tax bill by up to £238 a year in 2018/19. The government will now allow claims in cases where a partner died before the claim was made. These claims can be backdated by up to four years.

Scottish resident individuals are subject to Scottish rates of income tax from 6 April. For 2018/19, a new starter rate of 19% will apply to incomes between £11,850 and £13,850. The basic rate of income tax of 20% will continue to apply between £13,850 and £24,000 and a new intermediate rate of 21% will be introduced for income between £24,000 and £43,430. Higher rate tax on income between £43,430 and £150,000 is increased to 41% and additional rate tax for income above £150,000 is also increased from 45% to 46%. These new Scottish rates apply to non-savings income only (generally earnings). The tax rates applicable to savings and dividend income continue to be set by Westminster.

The inheritance nil rate band remains at £325,000 for 2018/19. The residence nil rate band which was introduced in 2017/18 will increase from £100,000 to £125,000 for deaths in 2018/19, £150,000 for deaths in 2019/20 and will rise to £175,000 for deaths on or after 6 April 2020. It is tapered at £1 for £2 for estates over £2m.

The ISA annual subscription limit remains at £20,000, and that for junior ISAs and child trust funds, the limit will be increased to £4,260 on 6 April 2018.

The landfill tax rates increase from 1 April 2018. This increases the standard rate to £88.95 per tonne and the lower rate to £2.80 per tonne.

The rules in relation to landfill tax will also be amended from 1 April 2018, to include within the scope of landfill tax disposals at sites without an environmental disposal permit (illegal waste sites) and to amend what constitutes a ‘taxable disposal’ for landfill tax purposes.

From 1 April 2018, landfill disposals tax will replace landfill tax in Wales. Landfill disposals tax will be administered by the Welsh Revenue Authority and will be payable by landfill operators in Wales. The rates are currently the same as landfill tax.

CO2 emission thresholds for certain capital allowance purposes change from April 2018:

The relevant emissions thresholds for the 15% restriction on corporation tax and income tax deductions for the costs of car hire (CTA 2009 s 56, ITTOIA 2005 s 48), are linked to the CAA thresholds and therefore reduce to 110 grams per kilometre from 1 and 5 April 2018 respectively, subject to grandfathering rules for existing leases.

Unincorporated property businesses will now have the option of calculating their allowable deductions for vehicle expenditure using the simplified flat rates based on business miles travelled, commonly referred to as ‘mileage rates’. These mileage rates are already available for self-employed traders and employees.

In 2018/19, the NIC rates will be as follows:

A number of changes were made to the taxation of offshore trusts, and to settlors and beneficiaries of those trusts, with effect from 6 April 2017. Further changes will have effect from 6 April 2018. The key points of relevance are:

Employers will soon have to report benefits for the first time (on P11Ds for 2017/18) taking account of the new OpRA legislation in force since 6 April 2017. OpRA applies when an employee receives a benefit instead of earnings, including arrangements under salary sacrifice/bonus waivers, cash alternatives, flexible benefits, and trade up/trade down arrangements for example. Broadly speaking the value of benefits provided under OpRA, will be the higher of the amount of earnings foregone or the taxable value of the benefit that would otherwise apply, although there are some exceptions. Arrangements that existed before 5 April 2017 for company cars and vans, private fuel, living accommodation and school fees can continue to be based on the existing rules without applying OpRA until 5 April 2021; or until 5 April 2018 in the case of other benefits. However, if any variation or renewal of an OpRA arrangement takes place before these dates, OpRA kicks in at that time for the benefit concerned. The overall value of a taxable benefit for the year in these circumstances will need to be calculated partly under the old rules, and partly under the new OpRA rules.

From 2018/19, the beneficiary of a bare trust will be treated as if they were a partner for UK income tax purposes, provided they are absolutely entitled to the trustee partner’s share of the profits of the firm.

A simplified process will allow employers to make permanent PAYE settlement agreements, rather than having to set up a new agreement every tax year. The new permanent agreements will be available from 6 April 2018. Computations will, of course, still have to be submitted annually.

From 2018/19, the lifetime allowance will increase from £1m to £1,030,000. This will come into effect as of 6 April 2018.

Further restriction of mortgage interest on rental properties

Phasing in since 2017/18 to 2020/21, the deduction for mortgage interest in respect of let properties will continue to be restricted to a basic rate tax reducer from 6 April 2018. In 2018/19, finance costs on residential properties will be further restricted such that only 50% finance costs will be an allowable deduction (down from 75% in 2017/18) and the remaining 50% will be given as a basic rate tax reduction (up from 25% in 2017/18). These percentages reduce and increase respectively over the period so that solely a basic rate reducer is available by 2020/21.

Land and buildings transaction tax (LBTT)

From 1 April, there is a requirement for certain commercial leaseholders in Scotland to submit a LBTT return every three years from the effective date of the lease.

Land transaction tax (LTT)

From 1 April, land transaction tax (LTT) will replace UK stamp duty land tax (SDLT) in Wales.

From 6 April 2018, businesses that produce, package or bring into the UK soft drinks with added sugar may need to register for and pay the soft drinks industry levy. The amount payable depends upon the sugar content of the drink. The levy is set at 18p per litre if the drink has 5g of sugar or more per 100ml, and 24p per litre if the drink has 8g of sugar or more per 100ml. Returns must be made quarterly, with the first return due in July 2018.

Payments in lieu of notice (PILONs) will become subject to tax as earnings and class 1 NIC where an employment is terminated after 5 April 2018 and any termination payment is also made after that date, subject to a new statutory formula. The balance of any termination award exceeding £30,000 will also become subject to class 1A NIC, but this will come into effect from 6 April 2019, having been delayed by a year. Injury to feelings will be excluded from the definition of ‘injury or disability’. Employers are advised to be particularly vigilant when applying the new rules as there are many grey areas and computational challenges.

Foreign service relief for employees who have had international careers will no longer be available for any employees who are UK resident at the time of termination, if after 5 April 2018. These employees will have to rely on international tax treaties for any relief in future.

Owners and leasers of tobacco manufacturing machinery are required to obtain a licence for each machine. Applications for licences will be accepted from 1 April 2018 and the Scheme will come into force on 1 August 2018.

From 1 April 2018, VED rates for cars, vans and motorcycles will increase.

A diesel supplement is also being introduced from 1 April 2018. The supplement applies to diesel vehicles registered from 1 April 2018 which do not meet the EU real driving emissions step two (RDE2) standard, with the effect that these cars will go up by one VED band when determining the VED rate that applies.