The following changes will apply for residential transactions with an effective date on or after 10 October 2022:

The other bands from £400,000 upwards are unchanged.

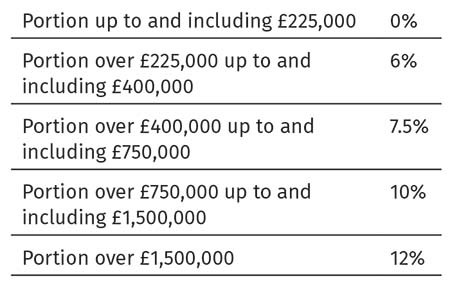

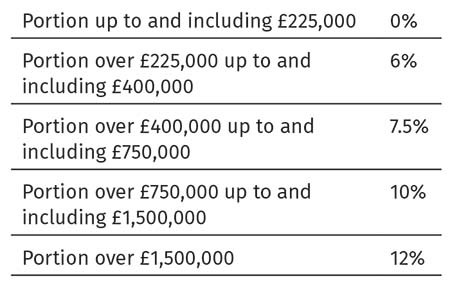

The revised bands and rates from 10 October 2022 are as follows:

Transitional rules will be introduced to ensure taxpayers who exchange contracts before the regulations making the changes come into force are protected from any tax increase.

The following changes will apply for residential transactions with an effective date on or after 10 October 2022:

The other bands from £400,000 upwards are unchanged.

The revised bands and rates from 10 October 2022 are as follows:

Transitional rules will be introduced to ensure taxpayers who exchange contracts before the regulations making the changes come into force are protected from any tax increase.