The class 1 NICs primary threshold increased to £12,570 on 6 July 2022, bringing the threshold into alignment with the income tax personal allowance. This aimed to soften the impact of the health and social care levy, which increased various rates of NICs by 1.25 percentage points from 6 April 2022 (and will be replaced by the separate health and social care levy from 6 April 2024).

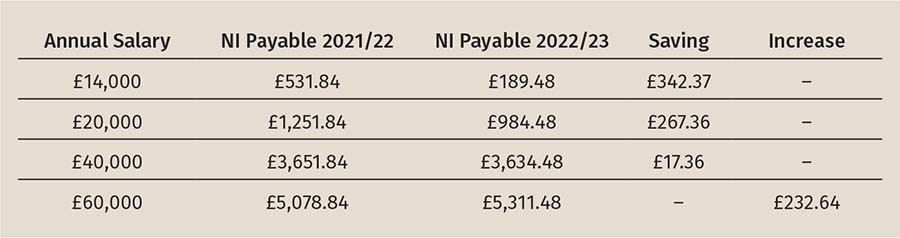

Accountancy firm HW Fisher summarises who will benefit from the increased primary threshold:

Christine Cairns, tax adviser at PwC, said: ‘This threshold increase is equivalent to a £356 national insurance cut for those employees earning £12,570 or more per year. For many this will more than offset the 1.25% increase in national insurance contributions which came into effect from 6 April 2022, and alleviate some of the pressure caused by the significant increase to the cost of living.’

Cairns also notes that the secondary (employer) threshold remains unchanged, meaning that NICs are ‘likely to impact decisions on any planned wage increases in the year ahead’ with some of the cost of the increase in NICs rates likely to be passed on to employees.

Cairns summarises: ‘The true impact of this cut will need to be assessed against the impact of the freezing of the income tax bands until 2026, as well as the rate of inflation and the increase to the cost of living.’

The class 4 lower profits limit (LPL) was increased to £11,908 for 2022/23, mirroring the annualised effect of the increase in the Class 1 primary threshold part-way through the tax year. With effect from 6 April 2023, the LPL will also rise to £12,570.

The class 1 NICs primary threshold increased to £12,570 on 6 July 2022, bringing the threshold into alignment with the income tax personal allowance. This aimed to soften the impact of the health and social care levy, which increased various rates of NICs by 1.25 percentage points from 6 April 2022 (and will be replaced by the separate health and social care levy from 6 April 2024).

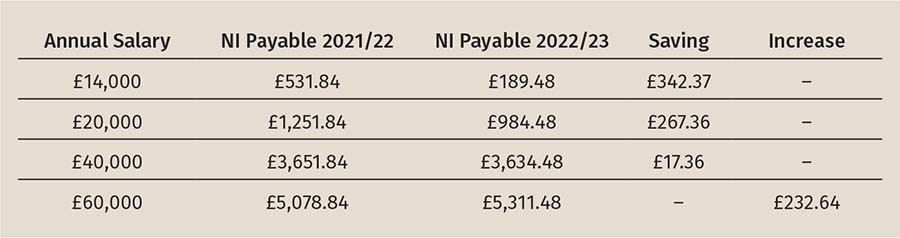

Accountancy firm HW Fisher summarises who will benefit from the increased primary threshold:

Christine Cairns, tax adviser at PwC, said: ‘This threshold increase is equivalent to a £356 national insurance cut for those employees earning £12,570 or more per year. For many this will more than offset the 1.25% increase in national insurance contributions which came into effect from 6 April 2022, and alleviate some of the pressure caused by the significant increase to the cost of living.’

Cairns also notes that the secondary (employer) threshold remains unchanged, meaning that NICs are ‘likely to impact decisions on any planned wage increases in the year ahead’ with some of the cost of the increase in NICs rates likely to be passed on to employees.

Cairns summarises: ‘The true impact of this cut will need to be assessed against the impact of the freezing of the income tax bands until 2026, as well as the rate of inflation and the increase to the cost of living.’

The class 4 lower profits limit (LPL) was increased to £11,908 for 2022/23, mirroring the annualised effect of the increase in the Class 1 primary threshold part-way through the tax year. With effect from 6 April 2023, the LPL will also rise to £12,570.