When negotiating an interest rate swap, the question of what tax representations are needed, or whether they are required at all, is sometimes asked. The (almost immediate) initial response is usually that none are needed and this is true where both parties are UK resident, thanks to a domestic exemption from withholding. On a cross-border transaction, this exemption will protect a UK company payor. However, representations are still needed, not because of any potential withholding (the usual need for tax representations) but due to a sneaky provision which prevents debit deductions where a counterparty is non-UK resident, unless an exemption applies (and for which a representation is required). One such exemption relates to double tax treaties and care is needed to apply the right treaty.

A derivative contract for tax purposes is defined at CTA 2009 s 576 and 577 as:

that satisfy certain accounting requirements and are not excluded by virtue of their underlying subject matter. Interest rate swaps, the focus of this article, fall within the definition of contracts for difference (HMRC’s Corporate Finance Manual at CFM 50380).

The general principle for derivative contracts, including swaps, is that their tax treatment follows the accounts, and proceeds are taxed or relieved as income (CTA 2009 s 571). As with any general rule, of course, this is subject to a host of exceptions and anti-avoidance beyond the scope of this article.

What this article does deal with is the question of what representations must be made, if any, when one has an interest rate swap. The ISDA 2002 Master Agreement (‘ISDA agreement’) is the contract most often used for a negotiated swap contract; and the tax representations are usually found in that at Part 2 of the Schedule to the ISDA agreement.

Where the swap is between only UK counterparties, the short answer is that no tax representations are usually required. The simple reason for this is that there is a blanket exclusion from withholding tax on derivative contracts at ITA 2007 s 980, provided that profits and losses derived from the same derivative are taxed within CTA 2009 Part 7. Generally, then, there is no withholding tax, and therefore no need for tax representations, if:

Even when the payee is non-UK resident, a UK payor will not generally require tax representations as to withholding, since the domestic exclusion in the derivative contracts regime should bite.

The gross-up provision at clause 2(d) of the main ISDA agreement confirms that where withholding is required, the payee should receive the same amount after that withholding; i.e. the payment to the payee is grossed up. The payor must, in that circumstance, also account for any withholding tax on the sum paid (including in respect of the grossed-up amount itself) to the relevant tax authority.

There are two well trodden points worth mentioning in respect of gross-up provisions. First, there may well be tax representations, but as far as withholding tax is concerned they will be for the benefit of an overseas payor; i.e. to enable it to avoid any withholding tax on what it pays to the UK payee (depending on its own domestic legislation – exemptions will typically track the relevant double tax treaty (DTT)). Second, whilst the gross-up provision is an undeniable benefit to the UK resident corporate payee, there are commercial considerations if a counterparty-payor has to pay more by way of gross up should there be withholding; i.e. no one typically enters into a swap actually expecting withholding tax to apply, and if it arises after execution it is usually a termination event under clause 5(b)(iii), so it is important to get it right.

However, despite there being no withholding tax (which is the usual reason for a tax representation), a tax representation may still be required even if the payor is a UK corporate entity and the derivative contract is within the CTA 2009 Part 7 regime.

The reason is a provision hidden away in CTA 2009 Part 7 Chapter 11 (tax avoidance). Note that the provision only became a ‘tax avoidance’ provision following the tax law rewrite project, having formerly been in FA 2002 Sch 26 para 31; this is arguably evidence of HMRC’s eagerness to converge the words ‘non-UK resident’ and ‘tax avoidance’.

In its current iteration, the offending provision is CTA 2009 s 696, and applies where a non-resident is or becomes a party to a derivative contract with a company under which notional interest payments may be made (CTA 2009 s 696(1)). A notional interest payment is defined (CTA 2009 s 696(4)) as a payment made:

Essentially, for our purposes, the provision applies to interest rate swaps. Where it does apply, the UK company is not allowed to deduct excluded debits received in relation to that contract (CTA 2009 s 696(2)). The ‘excluded debits’ are any excess notional interest payment paid to the non-resident above that which the company received from the non-resident (CTA 2009 s 696(3)); i.e. you lose your net deductions if the payee is in the wrong place (see below).

There are exceptions to the rule in CTA 2009 s 696 which effectively allow the otherwise prohibited debits under the derivative contract to be deducted in the company’s tax calculation. The anti-avoidance rule does not apply if:

2. the non-UK resident counterparty is:

3. the non-UK resident counterparty (or their agent or nominee, if relevant) is:

Obviously, if the exception at item 1 is in play, from a UK perspective, a representation is not required (in short, banking entities can usually ignore the whole issue).

If point 2 or point 3 of the above exceptions do apply (i.e. the other party has a permanent establishment in the UK to which the derivative contract relates or there is an applicable DTT), then a representation is required to confirm that effect. Doing so allows the UK company to legitimately deduct those debits which arise under the derivative contract. Without such a representation, the UK company will not know whether it may legitimately deduct any net debits on the interest rate swap in its accounts.

Further, when one has determined that a representation is needed, one should also look at the multi-branch clause in the derivative contract. In this instance, the drafter needs to also ensure that any representation is ‘forward facing’, such that the representation still holds true, should the payment recipients change. There is no use in the representation naming the current jurisdiction of a party in the swap if it is a multi-branch swap under clause 10. Instead, use the more flexible ‘jurisdiction of Party A’ (and corresponding definition of ‘Party A’) to give the desired flexibility.

For example, say a bank in Denmark acting through any one of six non-UK branches (Party A) is counterparty to a UK company (Party B). Your payee representation would look something like this:

‘(b) Payee Representation. For the purpose of Section 3(f) of this Agreement, Party A and Party B make the representations specified below, if any:

(i) The following representation will apply to Party A and will apply to Party B:

It is fully eligible for the benefits of the “Business Profits” or “Industrial and Commercial Profits” provision, as the case may be, the “Interest” provision or the “Other Income” provision, if any, of the Specified Treaty with respect to any payment described in such provisions and received or to be received by it in connection with this Agreement and no such payment is attributable to a trade or business carried on by it through a permanent establishment in the Specified Jurisdiction.

“Specified Treaty” means with respect to Party A the tax treaty between the Specified Jurisdiction and the Kingdom of Denmark.

“Specified Jurisdiction” means with respect to Party A the tax jurisdiction of the office through which Party B acts.

“Specified Treaty” means with respect to Party B the tax treaty between the Specified Jurisdiction and the tax jurisdiction of the home office of Party B.

“Specified Jurisdiction” means with respect to Party B the tax jurisdiction of the office through which Party A acts.’

Although not technically a tax representation, one should also check to ensure that a general ‘no agency’ representation is given/not removed in these circumstances. Usually, this is located in the main ISDA agreement, and is required for reasons that have nothing to do with tax. If it is there (it is in clause 3(g) and seldom disapplied in Part 4 (l) of the Schedule), then you probably do not need in practice to reflect the agency/nominee requirement in items 1 or 2 – it is effectively already covered off. However, if you are nervous about the technical distinction between agent and nominee, you can add an extra limb to Part 4(l):

‘Part 4(l) No Agency. The provision of Section 3(g) will apply to this Agreement, and each Party further represents that it is not entering into this Agreement, including each Transaction, as nominee of any person or entity.’

If you have to apply the DTT exemption in CTA 2009 s 697(3), or your counterparty wants a representation based on DTTs, then it is important to know which DTT applies.

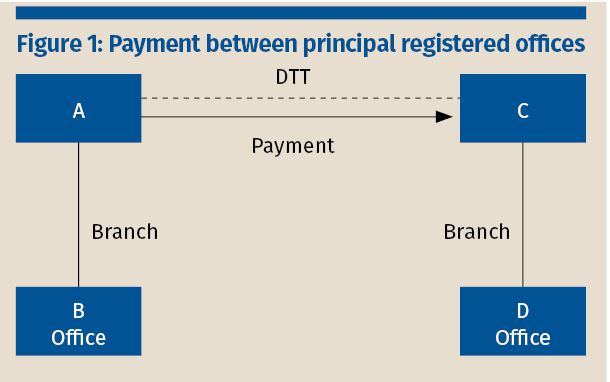

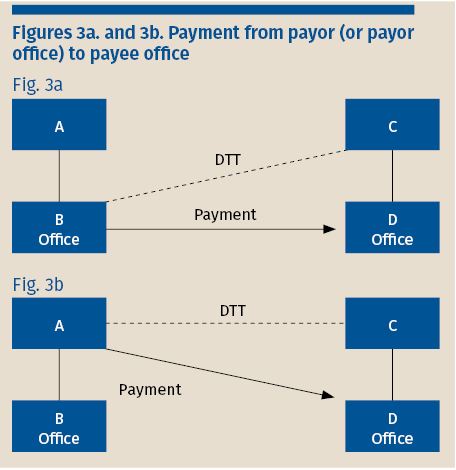

Where there are several potentially applicable DTTs, for example two entities act through (sometimes, several) branches, the answer may be more complicated. The following assumes that there are DTTs between each of countries A, B, C and D.

Where a payor in country A makes a payment to a payee in country C, the payor will need to ensure that there are no withholding taxes in its jurisdiction (country A) for which the payment will need to be grossed up. If A is in the UK, despite there being no withholding in any event, the non-deductibility of net debits problem is in point but should fall away if there is a DTT dealing with interest payments.

Where country A is outside the UK, the treatment will depend on its local domestic law. There may be a domestic exemption, as is the case in the UK, but if not (or if the domestic exemption tracks DTT requirements) you may need one of the standard representations in Part 2 of the Schedule. Exactly which part of the relevant DTT applies depends on how the country views swap payments – akin to interest, business profits or under the miscellaneous ‘other income’ heading – so the standard representations tend to refer to all the permutations.

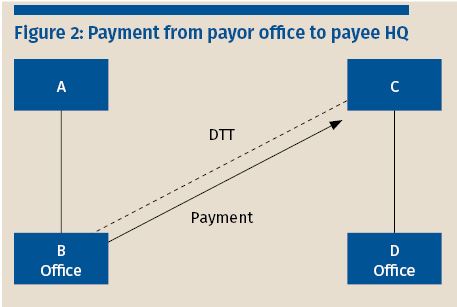

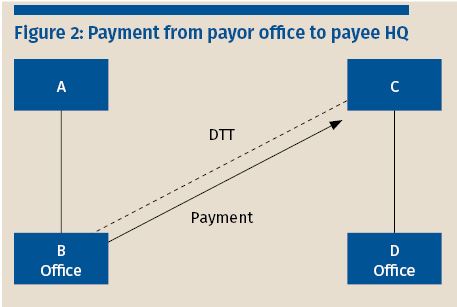

Where the payment arises in the branch located in country B rather than country A, and is paid to a payee in country C, the DTT between countries B and C applies: B, because that is the country of source, and C because that is where the payee is.

Generally, it will be relatively straightforward in swaps to determine whether the payment arises in country A or B, as it will usually be the jurisdiction that the trade is booked in. However, you do have to check the source of the payment, especially in the (fortunately rare) scenario where a treasury company bank account is making the payment on behalf of another group company.

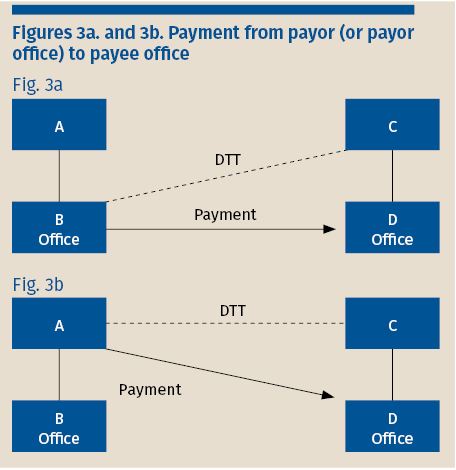

Here’s the catch. Where a swap payment is paid by the payor (either by itself or from the payor’s branch) to the payee’s branch or office, one must be careful not to automatically apply the DTT of the jurisdiction in which the payee’s branch, country D, is located. The question of which DTT to apply almost always follows the legal recipient of the payment, and a branch and HQ are one legal entity.

Instead, the payment to a branch in country D is governed by the DTT between the payor’s jurisdiction and the payee’s country of residence, country C. This is because DTTs typically refer to treaty benefits only being available to a resident of the other contracting state.

The payee is not, for these purposes, resident in the location which its office is based (country D) but instead its head office location under residency rules (country C). This is the case because most DTTs (per article 4 of the OECD model convention) exclude from residence any place whereby liability to tax in that state is only in respect of income from sources in that state (e.g. a permanent establishment).

On the basis that office D is merely a branch of the entity’s country C headquarters, the relevant DTT is that between: (i) the payor’s relevant jurisdiction (A or B, as applicable, depending on where the payment arises); and (ii) country C. The distinction may be important where country D does have a DTT but C does not.

The approach here is confirmed at the user’s guide to the ISDA agreement (para IV.B.4 of the 2003 edition).

Assuming country C has a DTT with the country of source (A or B), then no withholding should apply. However, if there any formalities to be complied with, look out for and expect any necessary tax documents to be listed in Part 3(a) of the Schedule.

Whilst the general rule that there is no withholding on derivative contracts provides general comfort for UK tax advisers dealing with derivative contracts, it is important not to rely on that rule to the extent that the hidden anti-avoidance provision of CTA 2009 s 696 is forgotten. If there is a non-UK resident counterparty, obtain appropriate tax representations for the exemption where possible. In doing so, remember that the branch jurisdiction of the payee is ignored when determining the relevant DTT: it is the jurisdiction in which the payee is resident that matters.

When negotiating an interest rate swap, the question of what tax representations are needed, or whether they are required at all, is sometimes asked. The (almost immediate) initial response is usually that none are needed and this is true where both parties are UK resident, thanks to a domestic exemption from withholding. On a cross-border transaction, this exemption will protect a UK company payor. However, representations are still needed, not because of any potential withholding (the usual need for tax representations) but due to a sneaky provision which prevents debit deductions where a counterparty is non-UK resident, unless an exemption applies (and for which a representation is required). One such exemption relates to double tax treaties and care is needed to apply the right treaty.

A derivative contract for tax purposes is defined at CTA 2009 s 576 and 577 as:

that satisfy certain accounting requirements and are not excluded by virtue of their underlying subject matter. Interest rate swaps, the focus of this article, fall within the definition of contracts for difference (HMRC’s Corporate Finance Manual at CFM 50380).

The general principle for derivative contracts, including swaps, is that their tax treatment follows the accounts, and proceeds are taxed or relieved as income (CTA 2009 s 571). As with any general rule, of course, this is subject to a host of exceptions and anti-avoidance beyond the scope of this article.

What this article does deal with is the question of what representations must be made, if any, when one has an interest rate swap. The ISDA 2002 Master Agreement (‘ISDA agreement’) is the contract most often used for a negotiated swap contract; and the tax representations are usually found in that at Part 2 of the Schedule to the ISDA agreement.

Where the swap is between only UK counterparties, the short answer is that no tax representations are usually required. The simple reason for this is that there is a blanket exclusion from withholding tax on derivative contracts at ITA 2007 s 980, provided that profits and losses derived from the same derivative are taxed within CTA 2009 Part 7. Generally, then, there is no withholding tax, and therefore no need for tax representations, if:

Even when the payee is non-UK resident, a UK payor will not generally require tax representations as to withholding, since the domestic exclusion in the derivative contracts regime should bite.

The gross-up provision at clause 2(d) of the main ISDA agreement confirms that where withholding is required, the payee should receive the same amount after that withholding; i.e. the payment to the payee is grossed up. The payor must, in that circumstance, also account for any withholding tax on the sum paid (including in respect of the grossed-up amount itself) to the relevant tax authority.

There are two well trodden points worth mentioning in respect of gross-up provisions. First, there may well be tax representations, but as far as withholding tax is concerned they will be for the benefit of an overseas payor; i.e. to enable it to avoid any withholding tax on what it pays to the UK payee (depending on its own domestic legislation – exemptions will typically track the relevant double tax treaty (DTT)). Second, whilst the gross-up provision is an undeniable benefit to the UK resident corporate payee, there are commercial considerations if a counterparty-payor has to pay more by way of gross up should there be withholding; i.e. no one typically enters into a swap actually expecting withholding tax to apply, and if it arises after execution it is usually a termination event under clause 5(b)(iii), so it is important to get it right.

However, despite there being no withholding tax (which is the usual reason for a tax representation), a tax representation may still be required even if the payor is a UK corporate entity and the derivative contract is within the CTA 2009 Part 7 regime.

The reason is a provision hidden away in CTA 2009 Part 7 Chapter 11 (tax avoidance). Note that the provision only became a ‘tax avoidance’ provision following the tax law rewrite project, having formerly been in FA 2002 Sch 26 para 31; this is arguably evidence of HMRC’s eagerness to converge the words ‘non-UK resident’ and ‘tax avoidance’.

In its current iteration, the offending provision is CTA 2009 s 696, and applies where a non-resident is or becomes a party to a derivative contract with a company under which notional interest payments may be made (CTA 2009 s 696(1)). A notional interest payment is defined (CTA 2009 s 696(4)) as a payment made:

Essentially, for our purposes, the provision applies to interest rate swaps. Where it does apply, the UK company is not allowed to deduct excluded debits received in relation to that contract (CTA 2009 s 696(2)). The ‘excluded debits’ are any excess notional interest payment paid to the non-resident above that which the company received from the non-resident (CTA 2009 s 696(3)); i.e. you lose your net deductions if the payee is in the wrong place (see below).

There are exceptions to the rule in CTA 2009 s 696 which effectively allow the otherwise prohibited debits under the derivative contract to be deducted in the company’s tax calculation. The anti-avoidance rule does not apply if:

2. the non-UK resident counterparty is:

3. the non-UK resident counterparty (or their agent or nominee, if relevant) is:

Obviously, if the exception at item 1 is in play, from a UK perspective, a representation is not required (in short, banking entities can usually ignore the whole issue).

If point 2 or point 3 of the above exceptions do apply (i.e. the other party has a permanent establishment in the UK to which the derivative contract relates or there is an applicable DTT), then a representation is required to confirm that effect. Doing so allows the UK company to legitimately deduct those debits which arise under the derivative contract. Without such a representation, the UK company will not know whether it may legitimately deduct any net debits on the interest rate swap in its accounts.

Further, when one has determined that a representation is needed, one should also look at the multi-branch clause in the derivative contract. In this instance, the drafter needs to also ensure that any representation is ‘forward facing’, such that the representation still holds true, should the payment recipients change. There is no use in the representation naming the current jurisdiction of a party in the swap if it is a multi-branch swap under clause 10. Instead, use the more flexible ‘jurisdiction of Party A’ (and corresponding definition of ‘Party A’) to give the desired flexibility.

For example, say a bank in Denmark acting through any one of six non-UK branches (Party A) is counterparty to a UK company (Party B). Your payee representation would look something like this:

‘(b) Payee Representation. For the purpose of Section 3(f) of this Agreement, Party A and Party B make the representations specified below, if any:

(i) The following representation will apply to Party A and will apply to Party B:

It is fully eligible for the benefits of the “Business Profits” or “Industrial and Commercial Profits” provision, as the case may be, the “Interest” provision or the “Other Income” provision, if any, of the Specified Treaty with respect to any payment described in such provisions and received or to be received by it in connection with this Agreement and no such payment is attributable to a trade or business carried on by it through a permanent establishment in the Specified Jurisdiction.

“Specified Treaty” means with respect to Party A the tax treaty between the Specified Jurisdiction and the Kingdom of Denmark.

“Specified Jurisdiction” means with respect to Party A the tax jurisdiction of the office through which Party B acts.

“Specified Treaty” means with respect to Party B the tax treaty between the Specified Jurisdiction and the tax jurisdiction of the home office of Party B.

“Specified Jurisdiction” means with respect to Party B the tax jurisdiction of the office through which Party A acts.’

Although not technically a tax representation, one should also check to ensure that a general ‘no agency’ representation is given/not removed in these circumstances. Usually, this is located in the main ISDA agreement, and is required for reasons that have nothing to do with tax. If it is there (it is in clause 3(g) and seldom disapplied in Part 4 (l) of the Schedule), then you probably do not need in practice to reflect the agency/nominee requirement in items 1 or 2 – it is effectively already covered off. However, if you are nervous about the technical distinction between agent and nominee, you can add an extra limb to Part 4(l):

‘Part 4(l) No Agency. The provision of Section 3(g) will apply to this Agreement, and each Party further represents that it is not entering into this Agreement, including each Transaction, as nominee of any person or entity.’

If you have to apply the DTT exemption in CTA 2009 s 697(3), or your counterparty wants a representation based on DTTs, then it is important to know which DTT applies.

Where there are several potentially applicable DTTs, for example two entities act through (sometimes, several) branches, the answer may be more complicated. The following assumes that there are DTTs between each of countries A, B, C and D.

Where a payor in country A makes a payment to a payee in country C, the payor will need to ensure that there are no withholding taxes in its jurisdiction (country A) for which the payment will need to be grossed up. If A is in the UK, despite there being no withholding in any event, the non-deductibility of net debits problem is in point but should fall away if there is a DTT dealing with interest payments.

Where country A is outside the UK, the treatment will depend on its local domestic law. There may be a domestic exemption, as is the case in the UK, but if not (or if the domestic exemption tracks DTT requirements) you may need one of the standard representations in Part 2 of the Schedule. Exactly which part of the relevant DTT applies depends on how the country views swap payments – akin to interest, business profits or under the miscellaneous ‘other income’ heading – so the standard representations tend to refer to all the permutations.

Where the payment arises in the branch located in country B rather than country A, and is paid to a payee in country C, the DTT between countries B and C applies: B, because that is the country of source, and C because that is where the payee is.

Generally, it will be relatively straightforward in swaps to determine whether the payment arises in country A or B, as it will usually be the jurisdiction that the trade is booked in. However, you do have to check the source of the payment, especially in the (fortunately rare) scenario where a treasury company bank account is making the payment on behalf of another group company.

Here’s the catch. Where a swap payment is paid by the payor (either by itself or from the payor’s branch) to the payee’s branch or office, one must be careful not to automatically apply the DTT of the jurisdiction in which the payee’s branch, country D, is located. The question of which DTT to apply almost always follows the legal recipient of the payment, and a branch and HQ are one legal entity.

Instead, the payment to a branch in country D is governed by the DTT between the payor’s jurisdiction and the payee’s country of residence, country C. This is because DTTs typically refer to treaty benefits only being available to a resident of the other contracting state.

The payee is not, for these purposes, resident in the location which its office is based (country D) but instead its head office location under residency rules (country C). This is the case because most DTTs (per article 4 of the OECD model convention) exclude from residence any place whereby liability to tax in that state is only in respect of income from sources in that state (e.g. a permanent establishment).

On the basis that office D is merely a branch of the entity’s country C headquarters, the relevant DTT is that between: (i) the payor’s relevant jurisdiction (A or B, as applicable, depending on where the payment arises); and (ii) country C. The distinction may be important where country D does have a DTT but C does not.

The approach here is confirmed at the user’s guide to the ISDA agreement (para IV.B.4 of the 2003 edition).

Assuming country C has a DTT with the country of source (A or B), then no withholding should apply. However, if there any formalities to be complied with, look out for and expect any necessary tax documents to be listed in Part 3(a) of the Schedule.

Whilst the general rule that there is no withholding on derivative contracts provides general comfort for UK tax advisers dealing with derivative contracts, it is important not to rely on that rule to the extent that the hidden anti-avoidance provision of CTA 2009 s 696 is forgotten. If there is a non-UK resident counterparty, obtain appropriate tax representations for the exemption where possible. In doing so, remember that the branch jurisdiction of the payee is ignored when determining the relevant DTT: it is the jurisdiction in which the payee is resident that matters.