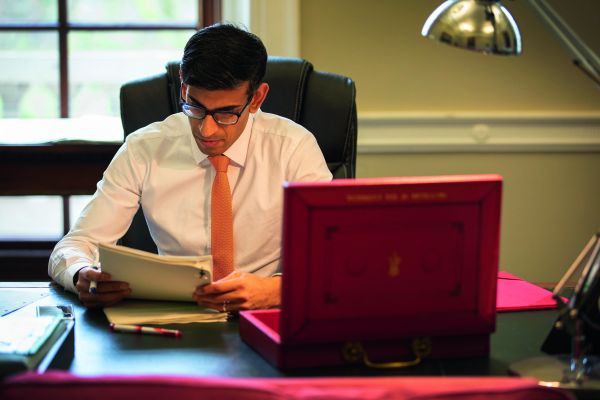

The big picture: a Budget … done?

By Chris Sanger (EY).

By political commentator Philip Stephens.

In its way, this was a rather unconservative Budget – with lots about increases in public spending, and much less about where the money is coming from. But if there ever was a time for a significant stimulus, this was surely it. The deeper question, as yet unanswered, is whether this was the moment the Conservatives abandoned low taxes in favour of free-spending political populism.

By Jill Gatehouse and John Tolman (Freshfields Bruckhaus Deringer).

By Andrew Marr (Forbes Dawson).

One of the main measures affecting SMEs is the reduction in the entrepreneurs’ relief lifetime allowance by £9m to £1m. There are anti-forestalling measures which seem to amount to retrospective legislation but have possible gaps in what they are trying to achieve. Pleasing Budget points are that electric cars continue to be an extremely tax efficient benefit for company owners and employees and inheritance tax remains untouched. It is surprising that residential SDLT rates continue to be increased for certain purchasers without addressing fundamental aspects of the rules which often make residential SDLT rates not applicable.

By Kate Ison and Jessica Hocking (Bryan Cave Leighton Paisner).

Clearly the government’s top priority in Budget 2020 was announcing its £30bn fiscal package in response to COVID-19. However, as foreshadowed in its manifesto, this new government announced a set of targeted measures ‘to ensure that businesses pay the tax they owe’ by clamping down on tax evasion, tax avoidance and tax non-compliance. The government set itself ambitious targets for additional tax revenue by 2024/25 and reinforced its intention to tackle tax avoidance through focusing increased resources at all levels of the so-called tax avoidance supply chain. However, many questions remain over the detail of a number of these new proposals.

By Sue Laing (Boodle Hatfield).

This Budget was the lightest on personal tax changes for many years. The main features were: the immediate scaling back of entrepreneurs’ relief to a £1m lifetime limit; the introduction of an SDLT surcharge of 2% on house purchases by non-residents from April 2021; some amelioration of the tapering of tax relieved pension savings, presumably to help medical practitioners; another warning on tax avoidance, evasion and non-compliance – the details of which we await; and a forthcoming call for evidence on raising standards for tax advice. But business and agricultural property reliefs from IHT remain untouched, at least for now.

By John Hawksworth (PwC).

This was a Budget of two halves, with the first being a package of emergency measures to mitigate the short-term economic impact of Covid-19, and the second being a more traditional Budget focused, in particular, on higher public investment in infrastructure and R&D. In his longer-term strategy, the chancellor is taking a calculated risk by committing now to significantly higher public spending when there are many economic uncertainties ahead.

A detailed guide to the key tax measures, by Lexis®PSL Tax.

The big picture: a Budget … done?

By Chris Sanger (EY).

By political commentator Philip Stephens.

In its way, this was a rather unconservative Budget – with lots about increases in public spending, and much less about where the money is coming from. But if there ever was a time for a significant stimulus, this was surely it. The deeper question, as yet unanswered, is whether this was the moment the Conservatives abandoned low taxes in favour of free-spending political populism.

By Jill Gatehouse and John Tolman (Freshfields Bruckhaus Deringer).

By Andrew Marr (Forbes Dawson).

One of the main measures affecting SMEs is the reduction in the entrepreneurs’ relief lifetime allowance by £9m to £1m. There are anti-forestalling measures which seem to amount to retrospective legislation but have possible gaps in what they are trying to achieve. Pleasing Budget points are that electric cars continue to be an extremely tax efficient benefit for company owners and employees and inheritance tax remains untouched. It is surprising that residential SDLT rates continue to be increased for certain purchasers without addressing fundamental aspects of the rules which often make residential SDLT rates not applicable.

By Kate Ison and Jessica Hocking (Bryan Cave Leighton Paisner).

Clearly the government’s top priority in Budget 2020 was announcing its £30bn fiscal package in response to COVID-19. However, as foreshadowed in its manifesto, this new government announced a set of targeted measures ‘to ensure that businesses pay the tax they owe’ by clamping down on tax evasion, tax avoidance and tax non-compliance. The government set itself ambitious targets for additional tax revenue by 2024/25 and reinforced its intention to tackle tax avoidance through focusing increased resources at all levels of the so-called tax avoidance supply chain. However, many questions remain over the detail of a number of these new proposals.

By Sue Laing (Boodle Hatfield).

This Budget was the lightest on personal tax changes for many years. The main features were: the immediate scaling back of entrepreneurs’ relief to a £1m lifetime limit; the introduction of an SDLT surcharge of 2% on house purchases by non-residents from April 2021; some amelioration of the tapering of tax relieved pension savings, presumably to help medical practitioners; another warning on tax avoidance, evasion and non-compliance – the details of which we await; and a forthcoming call for evidence on raising standards for tax advice. But business and agricultural property reliefs from IHT remain untouched, at least for now.

By John Hawksworth (PwC).

This was a Budget of two halves, with the first being a package of emergency measures to mitigate the short-term economic impact of Covid-19, and the second being a more traditional Budget focused, in particular, on higher public investment in infrastructure and R&D. In his longer-term strategy, the chancellor is taking a calculated risk by committing now to significantly higher public spending when there are many economic uncertainties ahead.

A detailed guide to the key tax measures, by Lexis®PSL Tax.