Finance (No. 2) Act 2023 received royal assent at on Tuesday 11 July 2023.

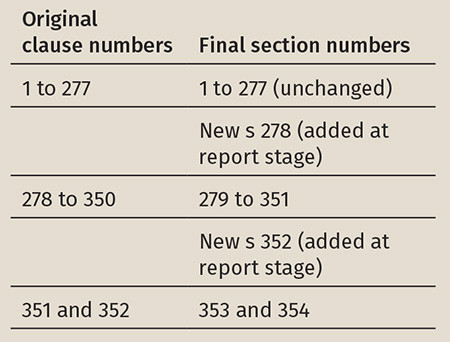

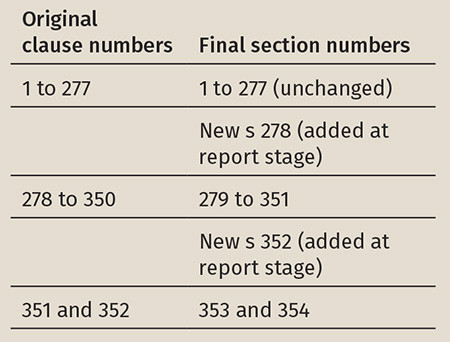

Two new clauses were added to the Bill during its passage through Parliament: clause 278 (domestic top-up tax commencement date) and clause 352 (communications data). As a result, the numbering of the Act differs slightly from the original version of the Bill, as follows:

The date of royal assent is significant not only in terms of when the Act comes into existence, but also because many provisions set out in the Act start to have effect from that date. For example, we now know that the following measures came into force on 11 July 2023:

Finance (No. 2) Act 2023 received royal assent at on Tuesday 11 July 2023.

Two new clauses were added to the Bill during its passage through Parliament: clause 278 (domestic top-up tax commencement date) and clause 352 (communications data). As a result, the numbering of the Act differs slightly from the original version of the Bill, as follows:

The date of royal assent is significant not only in terms of when the Act comes into existence, but also because many provisions set out in the Act start to have effect from that date. For example, we now know that the following measures came into force on 11 July 2023: