New data obtained by the Contentious Tax Group (CTG) shows the level of success taxpayers have had in the last four years in challenging HMRC decisions with HMRC’s own independent reviewer.

The data covers all manner of appeals from challenging tax and penalty determinations made by HMRC investigative departments forming part of HMRC’s Customer Compliance Group (CCG) to appeals against normally minor automatic late payment and late filing penalties dealt with by HMRC’s Customer Service Group (CSG).

The difference in taxpayer success rates is dramatic, depending on the type of appeal brought and the HMRC department involved.

Appeals against automatic penalties: By far the greatest level of success was enjoyed by taxpayers bringing tens of thousands appeals raised by HMRC Customer Service Group for automatic penalties such as the £100 penalty charged to people for being a day late filing their self-assessment tax returns. The usual grounds for challenging such penalties are that the taxpayer had a valid reasonable excuse. Implicitly, therefore, HMRC’s independent reviewer was broadly accepting of the reasons offered and granted errant taxpayers significant latitude. Although taxpayer success rates in appealing automatic penalties were higher during Covid and peaked at a 78% cancellation rate in 2020/21, that was a reflection of the exceptional excuses Covid provided. The recent increase to 70% cancellations in 2023/24 from 58% cancellations in 2022/23 appears to reflect the current and ongoing decline in HMRC customer service standards and the ever-greater difficulties experienced by taxpayers in trying get telephone assistance from HMRC to help them meet their obligations. Growing deficiencies in HMRC service standards appear to have led to HMRC having to cancel more of their own penalties.

Appeals against decisions by HMRC investigators: HMRC’s investigators are organised into five departments within HMRC CCG comprising:

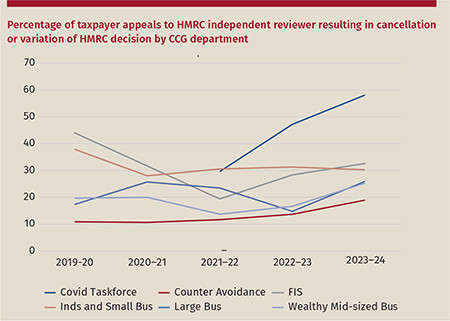

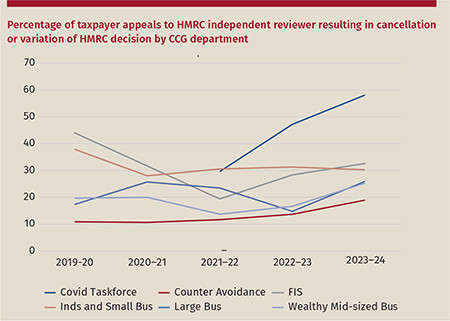

Additionally, during the three years to 2023/24, CCG also comprised the now disbanded Covid Taxpayer Protection Taskforce under the banner Compliance Operations Directorate. (See the chart below.)

Only a tiny and diminishing proportion of appeals against Counter-Avoidance decisions were successful in overturning the often very substantial assessments – down to 1% from 4% three years earlier. That’s unsurprising given HMRC’s success in targeting and shutting down the sort of schemes, including many film schemes, which they have challenged in the courts and the inflexible and consistent way in which taxpayer settlements are dictated as a matter of official policy. More surprising, though, is the increasing (now 18%) proportion of Counter-Avoidance decisions now varied, which suggests that although Counter-Avoidance have clarity on which schemes don’t work, in an increasing number of cases they’re not getting the detail and consistency of liabilities right.

Meanwhile, the number of Fraud Investigation Service tax assessments and penalty determinations successfully challenged is at a four-year high: in 2023/24, 22% were varied by the independent reviewer and 11% were cancelled altogether. A greater proportion of FIS decisions were cancelled or varied than decisions made in generally less serious cases by their counterparts dealing with individuals or businesses of all sizes – perhaps reflecting the greater complexity and subjectivity of many FIS cases.

Perhaps surprisingly, given the dismal success rate of taxpayers challenging HMRC Covid support-related decisions in the tax courts – where the courts have applied the Covid legislation rigidly and often with conspicuously unfair outcomes – the taxpayer has been far more successful in preventing appeals reaching that stage by appealing to the independent reviewer. A majority (58%) of Covid Taskforce appeals were at least partly successful in 2023/24, of which 21% of assessments and determinations were cancelled altogether. That’s also approximately double the initial success rate in 2021/22 – suggesting that the quality of HMRC’s initial decision making has sharply deteriorated, the independent reviewers are giving taxpayers more latitude, or maybe both.

New data obtained by the Contentious Tax Group (CTG) shows the level of success taxpayers have had in the last four years in challenging HMRC decisions with HMRC’s own independent reviewer.

The data covers all manner of appeals from challenging tax and penalty determinations made by HMRC investigative departments forming part of HMRC’s Customer Compliance Group (CCG) to appeals against normally minor automatic late payment and late filing penalties dealt with by HMRC’s Customer Service Group (CSG).

The difference in taxpayer success rates is dramatic, depending on the type of appeal brought and the HMRC department involved.

Appeals against automatic penalties: By far the greatest level of success was enjoyed by taxpayers bringing tens of thousands appeals raised by HMRC Customer Service Group for automatic penalties such as the £100 penalty charged to people for being a day late filing their self-assessment tax returns. The usual grounds for challenging such penalties are that the taxpayer had a valid reasonable excuse. Implicitly, therefore, HMRC’s independent reviewer was broadly accepting of the reasons offered and granted errant taxpayers significant latitude. Although taxpayer success rates in appealing automatic penalties were higher during Covid and peaked at a 78% cancellation rate in 2020/21, that was a reflection of the exceptional excuses Covid provided. The recent increase to 70% cancellations in 2023/24 from 58% cancellations in 2022/23 appears to reflect the current and ongoing decline in HMRC customer service standards and the ever-greater difficulties experienced by taxpayers in trying get telephone assistance from HMRC to help them meet their obligations. Growing deficiencies in HMRC service standards appear to have led to HMRC having to cancel more of their own penalties.

Appeals against decisions by HMRC investigators: HMRC’s investigators are organised into five departments within HMRC CCG comprising:

Additionally, during the three years to 2023/24, CCG also comprised the now disbanded Covid Taxpayer Protection Taskforce under the banner Compliance Operations Directorate. (See the chart below.)

Only a tiny and diminishing proportion of appeals against Counter-Avoidance decisions were successful in overturning the often very substantial assessments – down to 1% from 4% three years earlier. That’s unsurprising given HMRC’s success in targeting and shutting down the sort of schemes, including many film schemes, which they have challenged in the courts and the inflexible and consistent way in which taxpayer settlements are dictated as a matter of official policy. More surprising, though, is the increasing (now 18%) proportion of Counter-Avoidance decisions now varied, which suggests that although Counter-Avoidance have clarity on which schemes don’t work, in an increasing number of cases they’re not getting the detail and consistency of liabilities right.

Meanwhile, the number of Fraud Investigation Service tax assessments and penalty determinations successfully challenged is at a four-year high: in 2023/24, 22% were varied by the independent reviewer and 11% were cancelled altogether. A greater proportion of FIS decisions were cancelled or varied than decisions made in generally less serious cases by their counterparts dealing with individuals or businesses of all sizes – perhaps reflecting the greater complexity and subjectivity of many FIS cases.

Perhaps surprisingly, given the dismal success rate of taxpayers challenging HMRC Covid support-related decisions in the tax courts – where the courts have applied the Covid legislation rigidly and often with conspicuously unfair outcomes – the taxpayer has been far more successful in preventing appeals reaching that stage by appealing to the independent reviewer. A majority (58%) of Covid Taskforce appeals were at least partly successful in 2023/24, of which 21% of assessments and determinations were cancelled altogether. That’s also approximately double the initial success rate in 2021/22 – suggesting that the quality of HMRC’s initial decision making has sharply deteriorated, the independent reviewers are giving taxpayers more latitude, or maybe both.