The new Finance Act 2011 ‘designated currency’ election is available to investment companies for accounting periods beginning on or after 1 April 2011. The election allows investment companies a significant proportion of whose assets or liabilities are denominated in that currency, or whose currency is the accounting functional currency of the parent company of the group, to elect for that currency to be its functional currency for tax purposes. There are a number of practical issues and questions however, such as companies holding multiple currency assets and/or owing multiple currency liabilities, and intermediate companies with different functional currencies. This article seeks to draw attention to these issues as well as to the planning opportunities.

Finance Act 2011 s 34 and Sch 7 introduce a new election for hedging foreign exchange for tax purposes – the ‘designated currency election’ for investment companies.

Finance Act 2011 s 34 and Sch 7 introduce a new election for hedging foreign exchange for tax purposes – the ‘designated currency election’ for investment companies.

A basic principle of UK tax is that a company’s taxable profits should be calculated by reference to its accounting functional currency.

However, with effect from accounting periods beginning on or after 1 April 2011, UK investment companies can now elect for their taxable profits and losses to be determined in a currency (the ‘designated currency’) that is different from the functional currency used in the company’s accounts.

The UK investment company requirement

The ‘designated currency election’ is only available to a UK investment company which is defined, for these purposes, as being: ‘a company whose business consists wholly or mainly in the making of investments and the principal part of whose income is derived from those investments.’

This definition is effectively the pre-CT reform ICTA 1988 s 130 definition, and so is narrower than the CTA 2009 s 1218(1) definition of a company with investment business, that can claim management expenses.

Currency requirements

As well as meeting the UK investment company requirements, an election can only be made where one of the following conditions is met at the time the election is made:

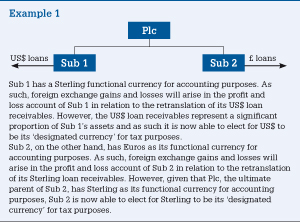

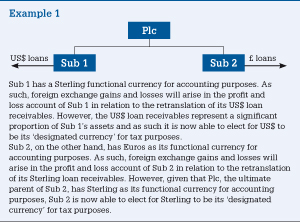

These requirements are illustrated by Example 1.

Timing of elections

An election made after 26 June 2001 must specify a day from which it is to have effect. The day specified in the election must be later than the day on which the election is made but can be the following day.

Newly incorporated companies may opt for the election to apply from incorporation provided that one of the ‘currency requirements’ (set out above) is met at the time the newly incorporated company’s first accounting period begins.

Different rules apply for elections made before 27 June 2011.

Any valid election will cease to be effective from the date:

Significant proportion of assets and liabilities

The meaning of significant is not defined in the legislation. HMRC have advised that they would clarify this in guidance and said that the decision should be based on the currency to which the company has the most forex exposure in terms of both assets and liabilities.

This may lead to uncertainty in determining whether an election in a certain currency would be possible.

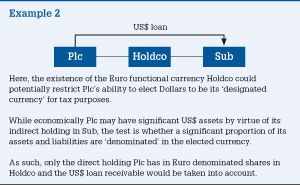

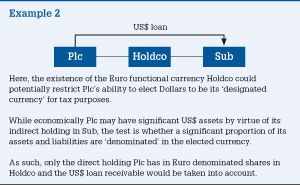

For example, the existence of an intermediate holding company could restrict a company with foreign denominated loans from being able to make an election, as set out in Example 2.

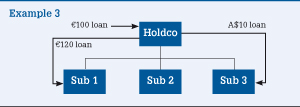

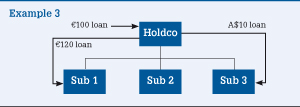

Another area of difficulty is where a company holds multiple currencies.

See Example 3.

The practical result of the above issues is that many groups are likely to have to restructure in order to make it clear that an election can be made.

In particular, companies are likely to need to consolidate foreign denominated lending / borrowing activity in a particular currency into a single entity.

Controlled foreign companies

The original draft of the designated currency election legislation was unclear as to how the rules would apply in the context of a controlled foreign company, for example, whether the CFC could make an election.

It has now been clarified that a UK company with a majority interest in a CFC will be able to make an election on behalf of a CFC.

Partnerships

The designated currency election only applies to companies and hence it shall not be possible for a partnership to make an election.

The foreign exchange treatment of partnerships is subject to separate rules.

The designated currency election provides groups with a further means to manage their exposure to foreign exchange gains and losses for tax purposes.

It is important to note, however, that the designated currency election will not affect the foreign exchange gains or losses that will be recognised in the individual entity or consolidated accounts; in most cases these will require further management.

It remains as important as ever, therefore, that the Tax, Treasury and Accounting functions all work very closely together to take a holistic approach to foreign exchange management.

Peter Cussons, International Corporate Tax Partner, PwC

The new Finance Act 2011 ‘designated currency’ election is available to investment companies for accounting periods beginning on or after 1 April 2011. The election allows investment companies a significant proportion of whose assets or liabilities are denominated in that currency, or whose currency is the accounting functional currency of the parent company of the group, to elect for that currency to be its functional currency for tax purposes. There are a number of practical issues and questions however, such as companies holding multiple currency assets and/or owing multiple currency liabilities, and intermediate companies with different functional currencies. This article seeks to draw attention to these issues as well as to the planning opportunities.

Finance Act 2011 s 34 and Sch 7 introduce a new election for hedging foreign exchange for tax purposes – the ‘designated currency election’ for investment companies.

Finance Act 2011 s 34 and Sch 7 introduce a new election for hedging foreign exchange for tax purposes – the ‘designated currency election’ for investment companies.

A basic principle of UK tax is that a company’s taxable profits should be calculated by reference to its accounting functional currency.

However, with effect from accounting periods beginning on or after 1 April 2011, UK investment companies can now elect for their taxable profits and losses to be determined in a currency (the ‘designated currency’) that is different from the functional currency used in the company’s accounts.

The UK investment company requirement

The ‘designated currency election’ is only available to a UK investment company which is defined, for these purposes, as being: ‘a company whose business consists wholly or mainly in the making of investments and the principal part of whose income is derived from those investments.’

This definition is effectively the pre-CT reform ICTA 1988 s 130 definition, and so is narrower than the CTA 2009 s 1218(1) definition of a company with investment business, that can claim management expenses.

Currency requirements

As well as meeting the UK investment company requirements, an election can only be made where one of the following conditions is met at the time the election is made:

These requirements are illustrated by Example 1.

Timing of elections

An election made after 26 June 2001 must specify a day from which it is to have effect. The day specified in the election must be later than the day on which the election is made but can be the following day.

Newly incorporated companies may opt for the election to apply from incorporation provided that one of the ‘currency requirements’ (set out above) is met at the time the newly incorporated company’s first accounting period begins.

Different rules apply for elections made before 27 June 2011.

Any valid election will cease to be effective from the date:

Significant proportion of assets and liabilities

The meaning of significant is not defined in the legislation. HMRC have advised that they would clarify this in guidance and said that the decision should be based on the currency to which the company has the most forex exposure in terms of both assets and liabilities.

This may lead to uncertainty in determining whether an election in a certain currency would be possible.

For example, the existence of an intermediate holding company could restrict a company with foreign denominated loans from being able to make an election, as set out in Example 2.

Another area of difficulty is where a company holds multiple currencies.

See Example 3.

The practical result of the above issues is that many groups are likely to have to restructure in order to make it clear that an election can be made.

In particular, companies are likely to need to consolidate foreign denominated lending / borrowing activity in a particular currency into a single entity.

Controlled foreign companies

The original draft of the designated currency election legislation was unclear as to how the rules would apply in the context of a controlled foreign company, for example, whether the CFC could make an election.

It has now been clarified that a UK company with a majority interest in a CFC will be able to make an election on behalf of a CFC.

Partnerships

The designated currency election only applies to companies and hence it shall not be possible for a partnership to make an election.

The foreign exchange treatment of partnerships is subject to separate rules.

The designated currency election provides groups with a further means to manage their exposure to foreign exchange gains and losses for tax purposes.

It is important to note, however, that the designated currency election will not affect the foreign exchange gains or losses that will be recognised in the individual entity or consolidated accounts; in most cases these will require further management.

It remains as important as ever, therefore, that the Tax, Treasury and Accounting functions all work very closely together to take a holistic approach to foreign exchange management.

Peter Cussons, International Corporate Tax Partner, PwC