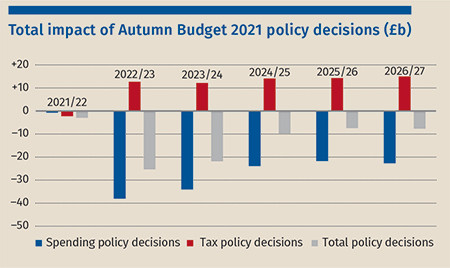

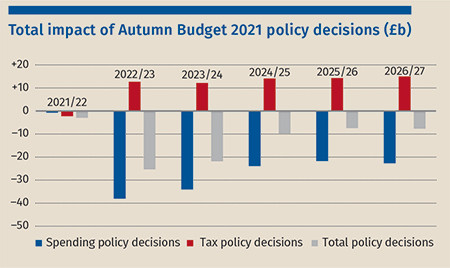

The Autumn Budget 2021 was small in form but huge in content. Having broken with tradition and announced most of his Budget in advance (and having been ticked off by both the speaker and the deputy speaker for his trouble), Rishi Sunak did not have an awful lot to unveil on Budget Day itself, particularly about tax. However, the actual business of the Budget – as set out in the Red Book – was big stuff, taking both taxing and spending to new heights.

Did the Budget have an overall theme?

Better than that, it had three. First there was the big message about continuing to support hard-working families and setting the foundation for ‘building back better’ and ‘levelling up.’ Second, there was a post-Brexit theme of simplifying and rationalising the UK tax system, no longer subject to the constraints imposed by being a member state of the European Union (EU). Finally, towards the end, there were sections to underline the chancellor’s Conservative credentials, as he explained that – notwithstanding the significant tax rises and spending commitments he had announced this year – he recognised the ‘limits’ of government and said he wanted taxes to be falling by the end of this Parliament.

‘News’ might not be quite the word for something which had been announced so long in advance, but the big tax story remains the national insurance increase to create the health and social care levy. Raising some £85bn over the scorecard period, this remains the single most important tax measure – even if it was only mentioned briefly in the Budget speech itself.

The newest news was in relation to a wholly new tax: the residential property developer tax, a hypothecated tax intended to fund the cost of post-Grenfell building de-cladding. As well as confirming a rate of 4% on profits over an annual allowance of £25m, the chancellor excluded build to rent assets and certain communal housing – such as care homes and purpose-built student accommodation – from the scope of the tax. This recognises the strong case made that the tax was too exhaustive in its original design, instead constraining it to the policy areas that the Government originally intended and reducing what could have been some significant collateral impact. Even so, some will be disheartened to see continued restrictions on relief for interest, especially given the high leverage of the real estate sector.

There was also news from two of the large-scale tax reviews which have been taking place over past months: the review of business rates and the review of alcohol duties.

On business rates, the chancellor opted to tinker with the current regime rather than attempt to reform it. The two biggest changes were the freeze in the business rates multiplier (a.k.a. the increase for inflation) for a second year and a new temporary business rates relief of 50% for eligible retail, hospitality and leisure properties. While it’s hard to call these just ‘tweaks’, given that they give away over £2.7bn next year, they nevertheless fall a long way short of the full-scale reform that was being called for. The shift to running revaluations every three years will help, but the impact of the business rates system will remain uneven across sectors, with retail paying a quarter of all rates, while only representing some five percent of the economy.

The chancellor did take the opportunity to deliver on an ask that had been on the desk of at least the last three chancellors: reducing the deterrent that business rates create for investment in buildings improvements, especially if these provide environmental benefits. A new 100% improvement relief for business rates, targeted exemptions for onsite renewable energy generation and storage, and 100% relief for eligible heat networks should all support the decarbonisation agenda.

By contrast, on alcohol it was reform rather than tinkering. No longer bound by EU rules, the chancellor announced a bonfire of the alcohol duties, moving from 15 main rates to six and simplifying the structure to relate duty rates to alcohol content. The reform will also include a common small producer relief – no longer just ‘small beer’! – to reduce the tax burden on smaller producers of wine, cider, spirits and made-wine below 8.5% ABV.

In addition, and with a nod to the pub sector, the chancellor introduced a new reduced duty rate on draught beer and cider, which will be set at 5% below the general rate. And to guarantee further good cheer, the rates on beer, cider, wine and spirits will be frozen for another year, at a cost of just over half a billion pounds.

The chancellor made quite a play for a vision of the UK as a high skill, innovative and (his word) ‘exciting’ economy. Central to that was his rebooting of research and development (R&D) tax reliefs. Firstly, this involves expanding qualifying expenditure to include data and cloud computing costs, another request that had been waiting in the in-tray of his predecessors. Secondly, to mark the departure from the EU, the territorial scope of the credit will be narrowed to apply only to UK spending, making the UK slightly less attractive to multinationals that were looking to run all their EU R&D from the UK, but providing a natural incentive for R&D to be undertaken here. The next steps for the review will be set later in the autumn.

In the same vein, the chancellor announced a modernisation of the tonnage tax scheme to ensure it favours UK-flagged vessels and is fit for the future.

Quite the reverse. The most cursory glance at the main sources of UK emissions would have identified air travel and car usage as suitable cases for some green tax treatment, whether carrots or sticks. However, this time out the chancellor has chosen to view these as cost of living issues rather than environmental ones, relying on today’s high prices to provide much of the impetus for taxpayers to behave in an environmentally friendly way. This has allowed him the freedom to avoid imposing further burdens just to change behaviour.

Adding an extra year to the decade-long cut in fuel duty was portrayed as helping the struggling motorist, while introducing a new long-haul band in air passenger duty – at the same time as reducing the tax burden for domestic flights – was seen as linking the duty to the environmental cost. Similarly, reductions in vehicle excise duty for heavy goods vehicles was linked to the existing supply chain pressures in the UK today, rather than longer-term concerns.

In essence, the chancellor chose to use his ability to spend money, rather than raise taxes, as his primary way to move towards net zero, something that may well be welcomed by those who would otherwise have faced increased taxes at this delicate time.

The online sales tax remains a sleeping dog, though the apparent conclusion of the business rates review suggest that two taxes have now been decoupled in Treasury thinking. In what should be an opportunity for the UK to demonstrate the strength of its consultation framework, we should expect to see a consultation document that sets out the potential for such a tax without a pre-conceived view as to whether it is will be introduced.

Beyond that, the much fretted-over alignment of CGT rates with income tax rates also remains quietly in its kennel.

Possibly reflecting the importance that tax administration now has a tool for delivering fiscal policy, we have been promised a whole day devoted to it. Following on from the alphabetical success of TPAC day (tax policies and consultations) at the Spring Budget, we are now promised TAMD (tax administration and maintenance day), when the government will bring forward a further set of tax administration and maintenance announcements. We can expect this to include the consultations that were announced today, as well as other elements arising between now and then. On timing, this is due ‘this Autumn’, which means any time between now and Christmas Day.

Those looking at the acronym may understand why the chancellor prefers tax administration to tax maintenance – a TaxMAD may not be quite the image that the chancellor wants to portray!

Curiously, we could almost find ourselves in ‘the last Budget’ territory. Seasoned Budget watchers will recall a time when Budget Day was the day when tax decisions were announced and tax policies were elaborated on a grand scale. Today, by contrast, offered almost a box-ticking exercise where the chancellor went through the motions of taking in the OBR forecast, setting out his scorecard and rubber stamping the big announcements he had already made – creating a distinct ‘Blue Peter’ feeling to the speech as the chancellor stood at the dispatch box holding up something he had made earlier. Without the supporting cast of the spending review, this might not have counted as a Big Day Out at all.

Being a thoroughly modern chancellor, Rishi Sunak has shown that you don’t need a Gladstonian showpiece to get the job done, however. Time will tell whether the new ways are best ways.

The Autumn Budget 2021 was small in form but huge in content. Having broken with tradition and announced most of his Budget in advance (and having been ticked off by both the speaker and the deputy speaker for his trouble), Rishi Sunak did not have an awful lot to unveil on Budget Day itself, particularly about tax. However, the actual business of the Budget – as set out in the Red Book – was big stuff, taking both taxing and spending to new heights.

Did the Budget have an overall theme?

Better than that, it had three. First there was the big message about continuing to support hard-working families and setting the foundation for ‘building back better’ and ‘levelling up.’ Second, there was a post-Brexit theme of simplifying and rationalising the UK tax system, no longer subject to the constraints imposed by being a member state of the European Union (EU). Finally, towards the end, there were sections to underline the chancellor’s Conservative credentials, as he explained that – notwithstanding the significant tax rises and spending commitments he had announced this year – he recognised the ‘limits’ of government and said he wanted taxes to be falling by the end of this Parliament.

‘News’ might not be quite the word for something which had been announced so long in advance, but the big tax story remains the national insurance increase to create the health and social care levy. Raising some £85bn over the scorecard period, this remains the single most important tax measure – even if it was only mentioned briefly in the Budget speech itself.

The newest news was in relation to a wholly new tax: the residential property developer tax, a hypothecated tax intended to fund the cost of post-Grenfell building de-cladding. As well as confirming a rate of 4% on profits over an annual allowance of £25m, the chancellor excluded build to rent assets and certain communal housing – such as care homes and purpose-built student accommodation – from the scope of the tax. This recognises the strong case made that the tax was too exhaustive in its original design, instead constraining it to the policy areas that the Government originally intended and reducing what could have been some significant collateral impact. Even so, some will be disheartened to see continued restrictions on relief for interest, especially given the high leverage of the real estate sector.

There was also news from two of the large-scale tax reviews which have been taking place over past months: the review of business rates and the review of alcohol duties.

On business rates, the chancellor opted to tinker with the current regime rather than attempt to reform it. The two biggest changes were the freeze in the business rates multiplier (a.k.a. the increase for inflation) for a second year and a new temporary business rates relief of 50% for eligible retail, hospitality and leisure properties. While it’s hard to call these just ‘tweaks’, given that they give away over £2.7bn next year, they nevertheless fall a long way short of the full-scale reform that was being called for. The shift to running revaluations every three years will help, but the impact of the business rates system will remain uneven across sectors, with retail paying a quarter of all rates, while only representing some five percent of the economy.

The chancellor did take the opportunity to deliver on an ask that had been on the desk of at least the last three chancellors: reducing the deterrent that business rates create for investment in buildings improvements, especially if these provide environmental benefits. A new 100% improvement relief for business rates, targeted exemptions for onsite renewable energy generation and storage, and 100% relief for eligible heat networks should all support the decarbonisation agenda.

By contrast, on alcohol it was reform rather than tinkering. No longer bound by EU rules, the chancellor announced a bonfire of the alcohol duties, moving from 15 main rates to six and simplifying the structure to relate duty rates to alcohol content. The reform will also include a common small producer relief – no longer just ‘small beer’! – to reduce the tax burden on smaller producers of wine, cider, spirits and made-wine below 8.5% ABV.

In addition, and with a nod to the pub sector, the chancellor introduced a new reduced duty rate on draught beer and cider, which will be set at 5% below the general rate. And to guarantee further good cheer, the rates on beer, cider, wine and spirits will be frozen for another year, at a cost of just over half a billion pounds.

The chancellor made quite a play for a vision of the UK as a high skill, innovative and (his word) ‘exciting’ economy. Central to that was his rebooting of research and development (R&D) tax reliefs. Firstly, this involves expanding qualifying expenditure to include data and cloud computing costs, another request that had been waiting in the in-tray of his predecessors. Secondly, to mark the departure from the EU, the territorial scope of the credit will be narrowed to apply only to UK spending, making the UK slightly less attractive to multinationals that were looking to run all their EU R&D from the UK, but providing a natural incentive for R&D to be undertaken here. The next steps for the review will be set later in the autumn.

In the same vein, the chancellor announced a modernisation of the tonnage tax scheme to ensure it favours UK-flagged vessels and is fit for the future.

Quite the reverse. The most cursory glance at the main sources of UK emissions would have identified air travel and car usage as suitable cases for some green tax treatment, whether carrots or sticks. However, this time out the chancellor has chosen to view these as cost of living issues rather than environmental ones, relying on today’s high prices to provide much of the impetus for taxpayers to behave in an environmentally friendly way. This has allowed him the freedom to avoid imposing further burdens just to change behaviour.

Adding an extra year to the decade-long cut in fuel duty was portrayed as helping the struggling motorist, while introducing a new long-haul band in air passenger duty – at the same time as reducing the tax burden for domestic flights – was seen as linking the duty to the environmental cost. Similarly, reductions in vehicle excise duty for heavy goods vehicles was linked to the existing supply chain pressures in the UK today, rather than longer-term concerns.

In essence, the chancellor chose to use his ability to spend money, rather than raise taxes, as his primary way to move towards net zero, something that may well be welcomed by those who would otherwise have faced increased taxes at this delicate time.

The online sales tax remains a sleeping dog, though the apparent conclusion of the business rates review suggest that two taxes have now been decoupled in Treasury thinking. In what should be an opportunity for the UK to demonstrate the strength of its consultation framework, we should expect to see a consultation document that sets out the potential for such a tax without a pre-conceived view as to whether it is will be introduced.

Beyond that, the much fretted-over alignment of CGT rates with income tax rates also remains quietly in its kennel.

Possibly reflecting the importance that tax administration now has a tool for delivering fiscal policy, we have been promised a whole day devoted to it. Following on from the alphabetical success of TPAC day (tax policies and consultations) at the Spring Budget, we are now promised TAMD (tax administration and maintenance day), when the government will bring forward a further set of tax administration and maintenance announcements. We can expect this to include the consultations that were announced today, as well as other elements arising between now and then. On timing, this is due ‘this Autumn’, which means any time between now and Christmas Day.

Those looking at the acronym may understand why the chancellor prefers tax administration to tax maintenance – a TaxMAD may not be quite the image that the chancellor wants to portray!

Curiously, we could almost find ourselves in ‘the last Budget’ territory. Seasoned Budget watchers will recall a time when Budget Day was the day when tax decisions were announced and tax policies were elaborated on a grand scale. Today, by contrast, offered almost a box-ticking exercise where the chancellor went through the motions of taking in the OBR forecast, setting out his scorecard and rubber stamping the big announcements he had already made – creating a distinct ‘Blue Peter’ feeling to the speech as the chancellor stood at the dispatch box holding up something he had made earlier. Without the supporting cast of the spending review, this might not have counted as a Big Day Out at all.

Being a thoroughly modern chancellor, Rishi Sunak has shown that you don’t need a Gladstonian showpiece to get the job done, however. Time will tell whether the new ways are best ways.