In recent years, the long-term incentive plan has been the vehicle of choice for the delivery of share awards to executive directors and senior management operated by FTSE 100 companies. Most long-term incentive plans operate by giving Remuneration Committees the discretion to make conditional share awards, nil cost options or grants of restricted shares. It is unlikely that 2011 will see a radical shift in the types of plan being operated, but a limited number of companies, are considering adopting value added plans and ‘co-ownership plans’. Other developments in this field include HMRC’s focus on the use of employee benefit trusts, and the threat of additional tax legislation that could affect ‘geared growth’ arrangements.

Jeremy Edwards reviews the types of share plans operated by FTSE 100 companies and identifies trends for 2011

By January of each year, the planning for the 2011 Annual General Meetings for most listed companies is well under way, as a large majority of meetings are held in late spring/early summer.

2011 is likely to be an interesting year in the executive remuneration area. Companies are still operating against a difficult economic background. However, for some, 2011 is likely to be a year when they would want to look forward and reevaluate the effectiveness of their executive remuneration plans.

Existing executive share plans

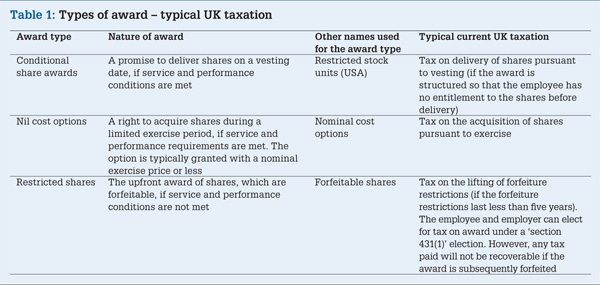

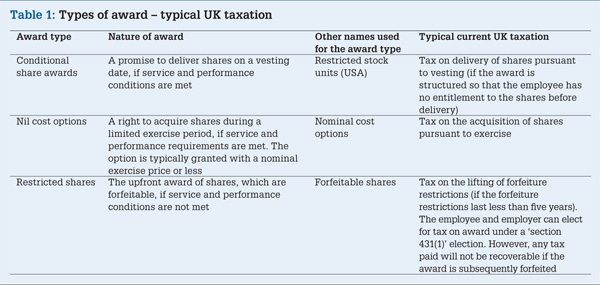

In recent years, the long-term incentive plan has been the vehicle of choice for the delivery of share awards to executive directors and senior management. Different names may be fashioned for such plans and there are obviously differences in the detail. However, in essence, most long-term incentive plans operate by giving Remuneration Committees the discretion to make conditional share awards, nil cost options or grants of restricted shares.

The awards vest or become exercisable (as the case may be) if service conditions and performance conditions are met over a vesting period (which, typically, in the UK context has been a period of three years). See Table 1.

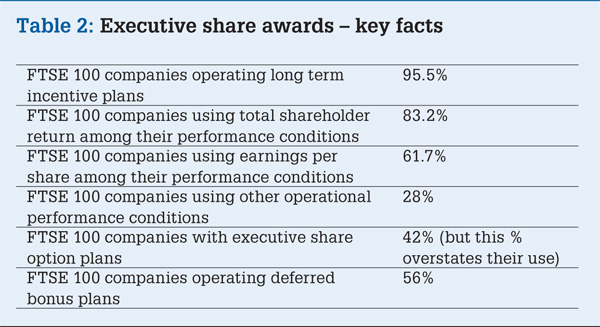

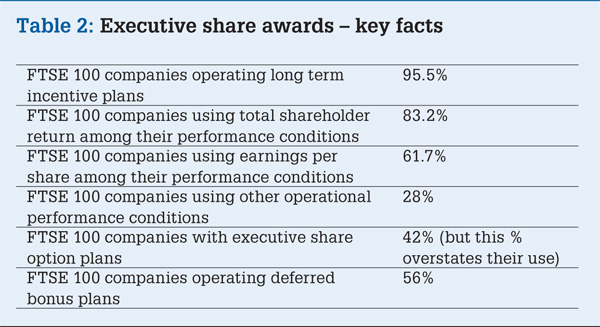

The audited reports and accounts reveal an overwhelming predominance of long-term incentive plans. Of the 110 companies reviewed in a Baker & McKenzie Survey (looking at 110 companies that have been in the FTSE 100 from the end of 2008), 105 out of 110 companies operated long-term incentive plans as a key component of their executive remuneration packages. This equates to approximately 95.5% of the companies surveyed.

The terms of participation tend to be broadly similar, as most of the FTSE 100 companies surveyed have attempted to follow the guidelines on executive remuneration published by the Association of British Insurers (ABI). The key component that will differ between different FTSE 100 companies are the performance conditions attaching to the awards.

It is also common for FTSE 100 companies to operate deferred share bonus plans. Sixty-two out of the FTSE 100 companies surveyed operate some kind of deferred share plan for their executive directors and senior management. There is less coherence in the market practice as to how such plans operate. Some involve a pre-tax deferral, while others operate by the executive acquiring shares from post-tax bonuses. Usually, the deferred share bonus plan involves the award of matching shares (on a 1 for 1 or a 2 for 1 basis), subject to the application of performance conditions.

The last ten years or so has seen a rapid demise in the use of market value options as a tool for incentivising senior executives. Of the FTSE 100 companies surveyed, there were only two clear examples of the FTSE 100 company using an option plan as a principal tool for remunerating senior executives. The Annual Reports of 46 out of the 110 companies surveyed noted the continued existence of executive share option plans. However, it is likely that in practice a large number of these companies are not currently granting new options under these plans. Approximately, 25% of the FTSE 100 companies surveyed noted openly that they are not granting options as part of executive remuneration. The position is in stark contrast to the 1980s, where executive options were the predominant tool for executive remuneration. See Table 2.

Likely trends in 2011

We are expecting more FTSE 100 companies to be re-appraising their share plans in 2011. Not surprisingly, companies have been reluctant to go to shareholders to obtain approval for new share plans during the economic downturn.

No radical shift in types of Plan being operated

It is unlikely that there will be a radical shift in the types of plan being operated.

That said, there is evidence that some companies are re-looking at their existing share plans. There is a degree of frustration building up among executives in some companies that their awards are still regularly failing to vest, despite the underlying performance of their companies now steadily improving. We would expect some reappraisal of the performance conditions to be attached to awards going forward. This may or may not involve a requirement to go back to shareholders, depending on the terms of the original plan that was approved by shareholders.

It is possible that the use of options may increase again, depending on the perception of particular companies on their likely future share price growth and whether companies want to use Revenue approved Company Share Option Plans more broadly (please see below).

In terms of presentation, some companies are likely to incorporate into their plans the ability to grant options. There is an increasing interest in an ‘umbrella’ plan that allows the Remuneration Committee the flexibility to grant different types of awards.

Uncapped incentive plans/ value added plans

A limited number of companies have adopted or are considering adopting value added plans, whereby participants receive a number of company shares that are determined by reference to an increase of the market capitalisation over a predetermined target level. These plans are more controversial for shareholders, as they involve giving participants a small percentage of the outperformance, which (if not carefully planned) could lead to substantial payouts not directly linked to the underlying fundamentals of the company.

Reflecting institutional shareholder concern, the ABI wrote to Remuneration Committee Chairmen on 7 January 2011 highlighting that their members will not be supportive of such arrangements unless prior observance has been given to the following:

Tax planning

The introduction of the 50% income tax for individuals earning more than £150,000 pa, restrictions on pensions and increases in employee NIC rates have put a spotlight on the tax effectiveness of share plans. From April 2011, most senior executives will be taxed at a rate of 52% on their share awards. This contrasts with the 28% tax rate for capital gains, which applies for higher earners.

Most FTSE 100 companies have avoided aggressive tax planning. In particular, most FTSE 100 companies have not put in place sub-trust arrangements of the type seen in the cases of MacDonald (HM Inspector of Taxes) v Dextra Accessories [2005] UKHC 47 and Sempra Metals Ltd v HMRC [2008] STC (SCD) 1062. The ability to operate such trusts has effectively been stopped by the proposed introduction of new legislation affecting employee benefit trusts being introduced in new ITEPA 2003 Part 7A.

While there may be a desire for executives to be subject to capital gains tax (rather than income tax and employee national insurance contributions), the opportunities for FTSE 100 companies to introduce tax effective share plans are in fact limited.

Executives can be granted market value options under the Revenue approved Company Share Option Plan (CSOP). However, the CSOP contains an individual limit over the number of shares subject to outstanding awards of £30,000. Further, the adoption of a CSOP requires approval from HMRC and continued monitoring of HMRC requirements. Nevertheless, there is anecdotal evidence that companies are considering adopting (or, in a large number of cases, resurrecting) CSOPs to provide for grants of options to wider groups of management and senior employees.

Another source of legitimate tax planning may be in an increased use of restricted shares. Where executives are granted restricted share awards, they can elect with their employer to enter into an election under ITEPA 2003 s 431(1) to be taxed upfront on the award of their shares. Any subsequent gains in value would then normally be taxed under the capital gains tax system. However, any tax or national insurance contributions paid will not be recoverable if the award is subsequently forfeited. As a result, given the stringent service and performance conditions normally attaching to executive awards, there has not been widespread use of restricted shares by FTSE 100 companies to date. This is an area that FTSE 100 companies could revisit in the context of their deferred share bonus plans and/or where a particular FTSE 100 company perceives that its current share price is low.

Co-ownership schemes

One alternative plan which some FTSE listed companies have been exploring is the adoption of a ‘co-ownership plan’. In essence, the co- ownership plan involves giving the executive an interest in a share which equates to the ‘hope’ or ‘future’ value of the share and not giving an interest to the executives over the ‘intrinsic’ value of the share. By giving only an interest in the extrinsic value of the share, the upfront value will be limited. Consequently, it will be much less risky for executives to enter into a s 431 election, with the result that they may be able to obtain capital gains tax treatment going forward.

The uptake of these plans has been limited to date. They are complex and, of course, do not deliver to the executive the underlying intrinsic value of the share. In addition, there have been announcements by HM Treasury of an intended consultation on the taxation of ‘geared growth arrangements’ both before and after last year's election – but, to date, no definitive proposals have materialised.

The co-ownership plans also need to be checked carefully to consider if they are caught by the new proposed legislation on employee benefit trusts being introduced in new ITEPA 2003 Part 7A.

New proposed legislation on employee benefit trusts

It is beyond the scope of this article to review in detail the new legislation on employee benefit trusts. However, it is worth noting the immediate concern for FTSE 100 companies that the legislation (as currently drafted) could affect the operation of their long-term incentive plans, as most use employee benefit trusts to deliver the shares under the awards and the legislation is so widely drawn.

It is somewhat frustrating not to see a carve-out from the legislation for employee share plans such as long-term incentive plans. With almost all FTSE 100 (and indeed FTSE 350) companies operating such plans, the new legislation could affect an important component of legitimate executive remuneration. The development of long-term incentive plans in their current form has been largely driven by institutional investor concerns on executive remuneration (and also reflects the desire of successive governments for companies to behave responsibly). The new legislation will therefore make life more difficult for companies which are addressing institutional and government concerns.

Other developments

The debate on executive remuneration is likely to be increasingly influenced by developments in the regulation of remuneration in the financial sector, which is posing its own set of issues for tax practitioners.

Jeremy Edwards, Partner, Baker & McKenzie LLP

In recent years, the long-term incentive plan has been the vehicle of choice for the delivery of share awards to executive directors and senior management operated by FTSE 100 companies. Most long-term incentive plans operate by giving Remuneration Committees the discretion to make conditional share awards, nil cost options or grants of restricted shares. It is unlikely that 2011 will see a radical shift in the types of plan being operated, but a limited number of companies, are considering adopting value added plans and ‘co-ownership plans’. Other developments in this field include HMRC’s focus on the use of employee benefit trusts, and the threat of additional tax legislation that could affect ‘geared growth’ arrangements.

Jeremy Edwards reviews the types of share plans operated by FTSE 100 companies and identifies trends for 2011

By January of each year, the planning for the 2011 Annual General Meetings for most listed companies is well under way, as a large majority of meetings are held in late spring/early summer.

2011 is likely to be an interesting year in the executive remuneration area. Companies are still operating against a difficult economic background. However, for some, 2011 is likely to be a year when they would want to look forward and reevaluate the effectiveness of their executive remuneration plans.

Existing executive share plans

In recent years, the long-term incentive plan has been the vehicle of choice for the delivery of share awards to executive directors and senior management. Different names may be fashioned for such plans and there are obviously differences in the detail. However, in essence, most long-term incentive plans operate by giving Remuneration Committees the discretion to make conditional share awards, nil cost options or grants of restricted shares.

The awards vest or become exercisable (as the case may be) if service conditions and performance conditions are met over a vesting period (which, typically, in the UK context has been a period of three years). See Table 1.

The audited reports and accounts reveal an overwhelming predominance of long-term incentive plans. Of the 110 companies reviewed in a Baker & McKenzie Survey (looking at 110 companies that have been in the FTSE 100 from the end of 2008), 105 out of 110 companies operated long-term incentive plans as a key component of their executive remuneration packages. This equates to approximately 95.5% of the companies surveyed.

The terms of participation tend to be broadly similar, as most of the FTSE 100 companies surveyed have attempted to follow the guidelines on executive remuneration published by the Association of British Insurers (ABI). The key component that will differ between different FTSE 100 companies are the performance conditions attaching to the awards.

It is also common for FTSE 100 companies to operate deferred share bonus plans. Sixty-two out of the FTSE 100 companies surveyed operate some kind of deferred share plan for their executive directors and senior management. There is less coherence in the market practice as to how such plans operate. Some involve a pre-tax deferral, while others operate by the executive acquiring shares from post-tax bonuses. Usually, the deferred share bonus plan involves the award of matching shares (on a 1 for 1 or a 2 for 1 basis), subject to the application of performance conditions.

The last ten years or so has seen a rapid demise in the use of market value options as a tool for incentivising senior executives. Of the FTSE 100 companies surveyed, there were only two clear examples of the FTSE 100 company using an option plan as a principal tool for remunerating senior executives. The Annual Reports of 46 out of the 110 companies surveyed noted the continued existence of executive share option plans. However, it is likely that in practice a large number of these companies are not currently granting new options under these plans. Approximately, 25% of the FTSE 100 companies surveyed noted openly that they are not granting options as part of executive remuneration. The position is in stark contrast to the 1980s, where executive options were the predominant tool for executive remuneration. See Table 2.

Likely trends in 2011

We are expecting more FTSE 100 companies to be re-appraising their share plans in 2011. Not surprisingly, companies have been reluctant to go to shareholders to obtain approval for new share plans during the economic downturn.

No radical shift in types of Plan being operated

It is unlikely that there will be a radical shift in the types of plan being operated.

That said, there is evidence that some companies are re-looking at their existing share plans. There is a degree of frustration building up among executives in some companies that their awards are still regularly failing to vest, despite the underlying performance of their companies now steadily improving. We would expect some reappraisal of the performance conditions to be attached to awards going forward. This may or may not involve a requirement to go back to shareholders, depending on the terms of the original plan that was approved by shareholders.

It is possible that the use of options may increase again, depending on the perception of particular companies on their likely future share price growth and whether companies want to use Revenue approved Company Share Option Plans more broadly (please see below).

In terms of presentation, some companies are likely to incorporate into their plans the ability to grant options. There is an increasing interest in an ‘umbrella’ plan that allows the Remuneration Committee the flexibility to grant different types of awards.

Uncapped incentive plans/ value added plans

A limited number of companies have adopted or are considering adopting value added plans, whereby participants receive a number of company shares that are determined by reference to an increase of the market capitalisation over a predetermined target level. These plans are more controversial for shareholders, as they involve giving participants a small percentage of the outperformance, which (if not carefully planned) could lead to substantial payouts not directly linked to the underlying fundamentals of the company.

Reflecting institutional shareholder concern, the ABI wrote to Remuneration Committee Chairmen on 7 January 2011 highlighting that their members will not be supportive of such arrangements unless prior observance has been given to the following:

Tax planning

The introduction of the 50% income tax for individuals earning more than £150,000 pa, restrictions on pensions and increases in employee NIC rates have put a spotlight on the tax effectiveness of share plans. From April 2011, most senior executives will be taxed at a rate of 52% on their share awards. This contrasts with the 28% tax rate for capital gains, which applies for higher earners.

Most FTSE 100 companies have avoided aggressive tax planning. In particular, most FTSE 100 companies have not put in place sub-trust arrangements of the type seen in the cases of MacDonald (HM Inspector of Taxes) v Dextra Accessories [2005] UKHC 47 and Sempra Metals Ltd v HMRC [2008] STC (SCD) 1062. The ability to operate such trusts has effectively been stopped by the proposed introduction of new legislation affecting employee benefit trusts being introduced in new ITEPA 2003 Part 7A.

While there may be a desire for executives to be subject to capital gains tax (rather than income tax and employee national insurance contributions), the opportunities for FTSE 100 companies to introduce tax effective share plans are in fact limited.

Executives can be granted market value options under the Revenue approved Company Share Option Plan (CSOP). However, the CSOP contains an individual limit over the number of shares subject to outstanding awards of £30,000. Further, the adoption of a CSOP requires approval from HMRC and continued monitoring of HMRC requirements. Nevertheless, there is anecdotal evidence that companies are considering adopting (or, in a large number of cases, resurrecting) CSOPs to provide for grants of options to wider groups of management and senior employees.

Another source of legitimate tax planning may be in an increased use of restricted shares. Where executives are granted restricted share awards, they can elect with their employer to enter into an election under ITEPA 2003 s 431(1) to be taxed upfront on the award of their shares. Any subsequent gains in value would then normally be taxed under the capital gains tax system. However, any tax or national insurance contributions paid will not be recoverable if the award is subsequently forfeited. As a result, given the stringent service and performance conditions normally attaching to executive awards, there has not been widespread use of restricted shares by FTSE 100 companies to date. This is an area that FTSE 100 companies could revisit in the context of their deferred share bonus plans and/or where a particular FTSE 100 company perceives that its current share price is low.

Co-ownership schemes

One alternative plan which some FTSE listed companies have been exploring is the adoption of a ‘co-ownership plan’. In essence, the co- ownership plan involves giving the executive an interest in a share which equates to the ‘hope’ or ‘future’ value of the share and not giving an interest to the executives over the ‘intrinsic’ value of the share. By giving only an interest in the extrinsic value of the share, the upfront value will be limited. Consequently, it will be much less risky for executives to enter into a s 431 election, with the result that they may be able to obtain capital gains tax treatment going forward.

The uptake of these plans has been limited to date. They are complex and, of course, do not deliver to the executive the underlying intrinsic value of the share. In addition, there have been announcements by HM Treasury of an intended consultation on the taxation of ‘geared growth arrangements’ both before and after last year's election – but, to date, no definitive proposals have materialised.

The co-ownership plans also need to be checked carefully to consider if they are caught by the new proposed legislation on employee benefit trusts being introduced in new ITEPA 2003 Part 7A.

New proposed legislation on employee benefit trusts

It is beyond the scope of this article to review in detail the new legislation on employee benefit trusts. However, it is worth noting the immediate concern for FTSE 100 companies that the legislation (as currently drafted) could affect the operation of their long-term incentive plans, as most use employee benefit trusts to deliver the shares under the awards and the legislation is so widely drawn.

It is somewhat frustrating not to see a carve-out from the legislation for employee share plans such as long-term incentive plans. With almost all FTSE 100 (and indeed FTSE 350) companies operating such plans, the new legislation could affect an important component of legitimate executive remuneration. The development of long-term incentive plans in their current form has been largely driven by institutional investor concerns on executive remuneration (and also reflects the desire of successive governments for companies to behave responsibly). The new legislation will therefore make life more difficult for companies which are addressing institutional and government concerns.

Other developments

The debate on executive remuneration is likely to be increasingly influenced by developments in the regulation of remuneration in the financial sector, which is posing its own set of issues for tax practitioners.

Jeremy Edwards, Partner, Baker & McKenzie LLP